In the last quarter of 2021, Binance introduced the Binance Evolution Protocol, BEP-95. The said update introduced a real-time burn mechanism in BSC’s economic model to make the tokenomics dynamic.

The main idea behind the said Binance Evolution Protocol aimed to speed up the BNB token burning process and make the chain even more decentralized. For example, a fixed proportion of the collected gas fee is burned in each block. The same is established by BSC validators.

BNB Milestone Alert

Quite recently, the protocol unlocked a new achievement. The number of tokens burned since the BEP burn upgrade exceeded 100k.

On Wednesdays the number was up to 100,314.05 BNB. As a result, the total value of the tokens removed from the stock was $23,464,459.44.

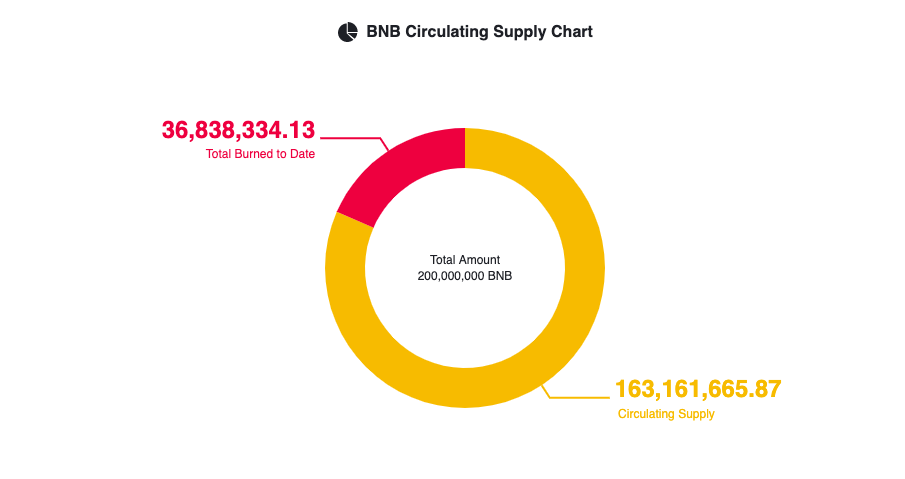

The BEP-95 real-time burning system as such is limited to the activity on the BSC network. However, it is worth recalling that BNB also uses an auto-burn system that plans to reduce the total supply to 100,000,000 BNB. The said mechanism adjusts the amount of BNB to burn based on the price of the asset and the number of blocks generated on the BNB Smart chain during each quarter.

Now, with the real-time combustion in place, even after reaching the target supply of 100 million BNB in circulation, even after reaching the target supply of 100 million BNB in circulation. The same is expected to help in increasing the price of BNB.

So now, with both mechanisms in play, over 36 million tokens have been burned.

Cross-comparison: BNB v. ETH, SHIB

Other protocols such as Shiba Inu and Ethereum also have their burning mechanisms in play. The Shiba Inu brand portal was launched by the developers of the team this year. However, most fire initiatives are community-driven. On favorable occasions, the SHIB army usually arranges for a large portion of the tokens to be sent to dead wallets. In addition, through various mechanisms, the circulating supply of SHIB is reduced on a daily basis.

Ethereum, on the other hand, introduced combustion in its EIP-1559 upgrade that took place last year. The same introduced a mechanism that burns a portion of the gas fee with every Ethereum transaction. As such, the update was intended to adjust Ethereum’s fees market and make fees predictable.

Despite frequent burns, none of the protocol’s tokens have become completely deflationary. On days when the burn rate has increased, their prices have responded positively, but they have not been able to maintain it consistently. However, things are expected to change for the better in the long run, provided combustion continues and the reduced supply improves over time.