There is currently very little to be optimistic about Bitcoin. The price is still consolidating at around $ 20,000 and several indicators on the chain are becoming bearish. While the long-term market indicates further decline, there may be some form of temporary respite over the next week. Few signs indicate recovery, and this could lead to a possible bounce over the weekend.

Active addresses to the rescue?

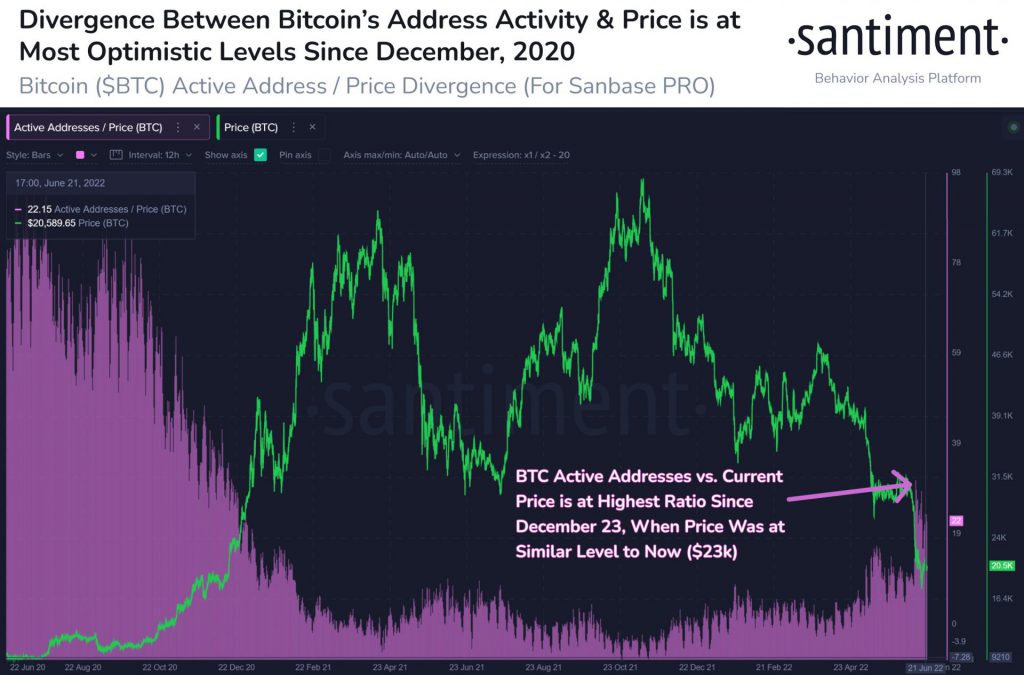

According to Santiment, the number of unique Bitcoin addresses currently interacting in the network has increased. This is positive reinforcement for a bullish rally and a similar divergence was last formed in December 2020. During the same period, BTC peaked at its 2017 high of $ 20,000.

Another bullish sign that has been observed includes Coinbase outflows of Bitcoin whales. At time of printing, the average BTC outflow on Coinbase reach up to 9 years high. However, it is important to note that their average inflow was also significantly high.

In contrast, mining sales pressure continued to increase and some analysts expected a capitulation period influenced by miners. If you keep it aside for the moment, BTC’s price may react in the following way.

Bitcoin Moonshot and back?

Now moonshine may be a term used out of context in this scenario, but a retest on the $ 23,030 resistance will also be welcomed. Currently, BTC’s price is recovering on a slope resistance (yellow line), but the scenario will improve significantly if the asset jumps above the aforementioned resistance. After a strong rally, a lack of resistance could raise its valuation to just under $ 30,000.

While the asset would remain more than 50% behind its all-time high, there would be some reduction in losses. Historically, the $ 17,000- $ 20,000 price range has become one of the most traded ranges in BTC’s history.

Over the week, Bitcoin could potentially swing in either direction and the weekend will be a crucial time to plan trading strategies around the biggest digital asset. However, it is important to keep in mind that the market remains bearish and risk management is extremely important for investors.