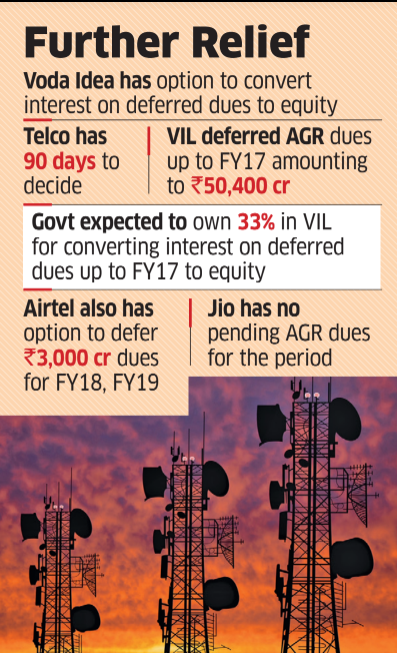

Bharti Airtel, who received a similar offer to defer his membership fees of approximately Rs3 000 crore for the period, “is studying the option and will respond by the deadline (June 30),” said a person familiar with the case said. This offer does not apply to Reliance Jio Infocomm, which does not have pending fees for the period, another person said. Airtel and Jio did not comment.

The government has already allowed telcos to defer AGR fees to FY17 by four years. Vodafone Idea and Airtel said they would defer those fees, but only the former agreed to convert the accrued interest into equity, which would result in the government holding a 33% stake. Telcos pay license fees and spectrum usage fees to the government based on AGR.

In similar letters dated June 15, the DoT asked all three private telcoes to make a decision on the postponement of AGR payments within 15 days. “The said DoT letter also offers the company an option for share conversion of interest fees in advance for these AGR-related fees for which a period of 90 days has been provided from the date of the said DoT letter,” said Vodafone Idea in a notice to the stock exchanges late Wednesday night.

The loss-making company’s board of directors approved at its June 22 meeting “the exercise of the option to defer the AGR-related charges for a period of four years with immediate effect,” Vodafone Idea said in its notice. The telecommunications company has not yet called for the conversion of accrued interest into state equity. The new deferral option could mean that the government can hold an additional 5-7% share, apart from the currently expected 33%, in the telco, if Vodafone Idea opts for the conversion option, according to analysts.

‘The government can finally hold up to 40%’

“The final incremental interest will depend on the interest rate and the price at which it is converted into shares, but as a ballpark, the government will hold up to 40% stake in VIL,” one of them said.

Even with 33%, the government would be the largest single shareholder in the company. Promoters Vodafone Plc and the Aditya Birla Group will together hold a 50% stake.

The operator did not respond to inquiries about the possible extent of government ownership.

Vodafone Idea said earlier that since the average price of the company’s shares was below par value on the relevant date of 14 August 2021, the equity shares will be issued to the government at the interest rate on AGR fees up to FY17 at par value. of Rs 10 per share, subject to final confirmation by the DoT.

Vodafone Idea shares closed at Rs8.55 on Thursday, up 0.2% on the BSE.

The loss-making telco’s AGR fees up to FY17 amounted to Rs 58,254 crore, of which he paid Rs 7,854 crore. Airtel, the second largest telecommunications company, had Rs43,000 crore fees from FY17; it paid Rs18 004 crore of this.

“When the relief package was announced, it considered the fees up to FY17, based on the Supreme Court order. The understanding was that telco would be given the choice to defer incremental fees thereafter as well. This letter from DoT is the result of the same, ”said another operations manager.

While the continued postponement will provide cash flow relief to the telecommunications company, to be competitive in the market and turn operations around, Vodafone Idea urgently needs to complete its Rs10 000 crore fundraising from external investors, experts said. The Rs 4,500 crore raised by its promoters through new shares earlier this year is not enough, analysts said. On 22 June, the board of directors of Telco approved another Rs 436 crore from British promoter Vodafone Group.