Bitcoin has barely gained a concrete olive branch in recent weeks and most of the data and speculation is pointing to another round of sell-offs. While multiple arguments suggest that the bottom is in or near, the reports continue to flood bearish sentiments across the board.

An investment vehicle was also formed by ProShares’ that allows investors to short Bitcoin to make a profit during the downtime. BITI, the short bitcoin ETF, was released just a week ago and is already the second largest US bitcoin-related ETF.

BITI Putting Further Pressure on Bitcoin Price?

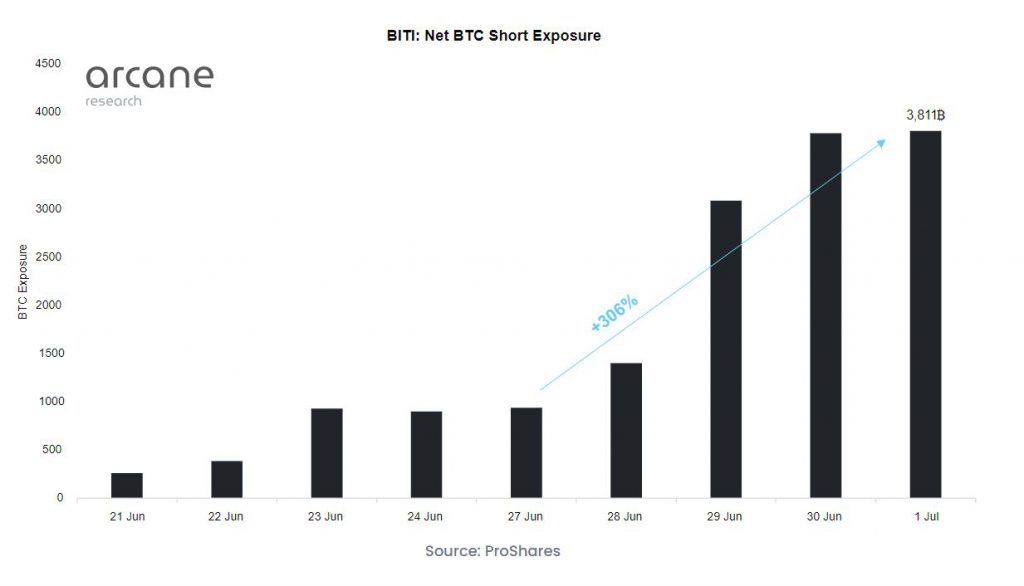

According to mysterious investigationBITI’s net exposure has increased by 300% in the past week. At the time of writing, more than 3,800 BTC has been hedged on the investment vehicle, where the depreciation of BTC would yield a profit for the investors. One of the main reasons for such an increase in net exposure is the inflows on 29 and 30 June. 1684 BTC and 700 BTC were quickly injected into BITI, potentially increasing the selling pressure on Bitcoin.

This may look very bearish, but it is important to note that BITI makes up only 12% of the size of Proshares BITO. Most US ETF investors are still essentially exposed to Bitcoin for a long time.

Does it leave BTC out of sight of the bear?

Most analysts don’t think Bitcoin will recover anytime soon. As noted by Peter Brandt, BTC’s price has been a pennant of historical bearish sentiment in recent months.

In addition, the increased inflows in short BTC ETF came weeks after more than $400 million was withdrawn from Bitcoin and other crypto products. Amid these moves, mounting concerns about inflation and recession are mounting. Jerome Powell, chairman of the US Federal Reserve, stated that the central bank would continue to raise interest rates to curb inflation, indirectly pushing the US economy into a period of recession.

However, the Fear and Greed Index for Bitcoin hit the top of the charts in two months, indicating that the current price remains a buying opportunity. The only problem remains that these indicators are not exactly quantifiable and the numbers continue to lean towards another sell-off. It could be a rough week for Bitcoin, and pressures will continue to mount for the digital asset, which is currently consolidating near $20,000.