As a result of increasingly strict Western sanctions that blocked payment options to international creditors, Russia experienced its first sovereign default on foreign-currency debt in a century.

The nation worked for months over the sanctions imposed after the Kremlin invaded Ukraine. But on Sunday night, the grace period scheduled for May 27 ended for nearly $100 million in arrears in interest. If this date is missing, it is considered a standard event.

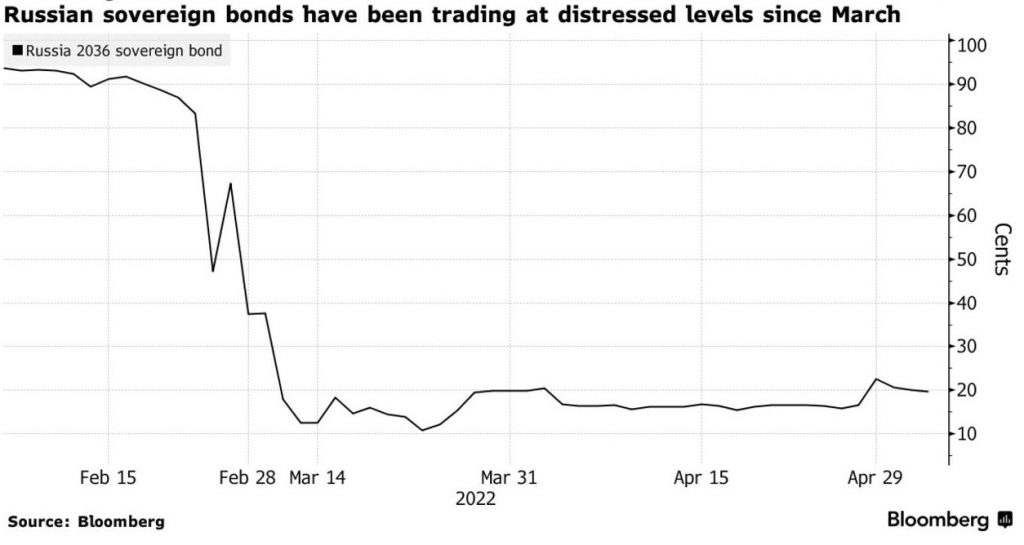

Since early March, the country’s Eurobonds have been trading at desperate prices, the central bank’s foreign exchange reserves have been frozen and the largest banks have been cut off from the rest of the world’s financial system.

However, the default is also mainly symbolic for the time being, given the damage that the economy and markets have already done. It means little to Russia, which is grappling with double-digit inflation and its worst economic turmoil in years.

Russia has resisted designating default, claiming it has the money to pay all its debts and has been forced to do so. It began last week that it would proceed to pay its $40 billion in ruble-denominated public debt in an attempt to criticize the West for fabricating a “force majeure” situation.

Hassan Malik, senior sovereign analyst at Loomis Sayles & Company LP, said:

“It’s a very, very rare case where a government that otherwise has the resources is forced to default by an outside government.” […] It will be one of the largest defaults in history.”

Rating agencies would usually make a public statement, but due to European sanctions, they have stopped rating Russian companies. Owners of 25% of the outstanding bonds must agree that an “Event of Default” has occurred for holders of the bonds whose grace period expired on Sunday to call one yourself.

Attention now turns to what investors should do after the final deadline has passed.

They are not required to take immediate action and may decide to monitor the development of the war in the hope that sanctions will eventually be relaxed. They can take advantage of the time because under the bond agreements, claims are not invalid until three years after the payment date.

After the US Treasury Department cleared a loophole in sanctions, it removed the exception that allowed US bondholders to receive payments from the Russian state, leaving the money locked up. A week later, the National Settlement Depository, the Russian payment agency, also received sanctions from the European Union.

Vladimir Putin responded by introducing new laws stating that when the required amount in rubles is paid to the regional paying agent, Russia’s obligations for foreign currency bonds are met.

Under those rules, the Treasury Department made its most recent interest payments on Thursday and Friday, totaling nearly $400 million. However, none of the underlying bonds have terms that allow settlement in the local currency.

Investors’ use of the new mechanism and whether the current sanctions even allow money to be repatriated are currently unknown.