The cryptocurrency market faced another macroeconomic data release. The figures of the US Consumer Price Index (CPI) for June 2022 are known and the figures were not favourable. The CPI While annual inflation is expected to be around 8.8%, reports have indicated a rise of 9.1%, which will be another 40-year high in consecutive months. Bitcoin and the collective crypto market faced a short-term correction.

Another round of Bitcoin tumble?

In June 2022, the May CPI data was considered one of the main catalysts for Bitcoin falling below $30,000. A similar situation temporarily occurred yesterday. After the data was released, Bitcoin fell below $18,000 and the market expected more corrections. However, at press time, it clawed back above $20,000.

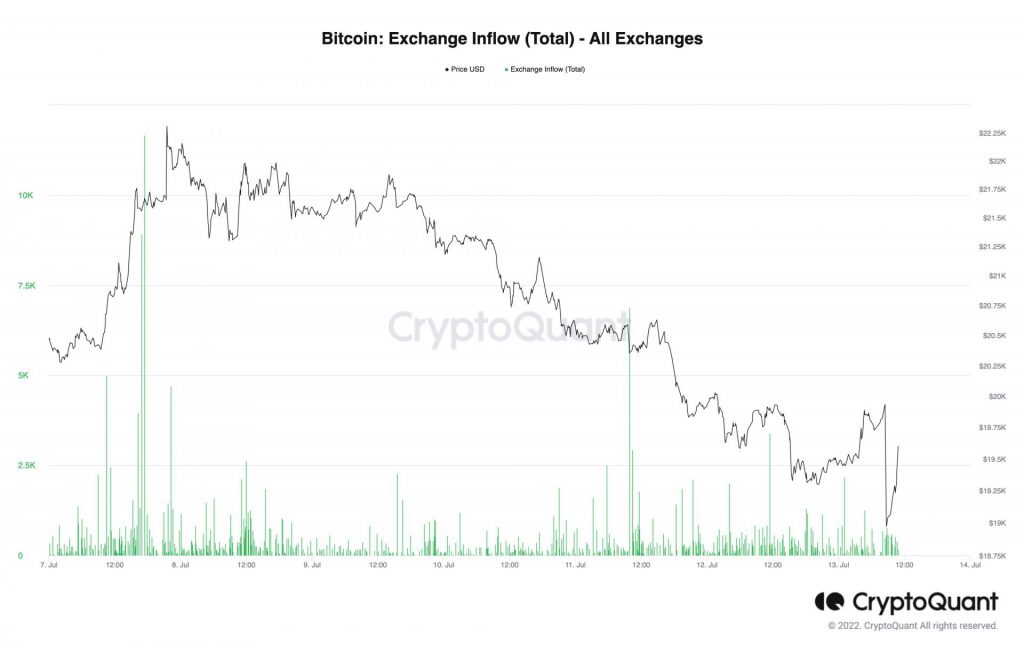

The release of CPI numbers also caused a small shift in the on-chain data. According to Cryptoquant, the influx of Bitcoin exchanges registered a small increase, as can be seen in the charts. Bitcoin going back to the exchanges usually increases the selling pressure for the asset.

Now, with inflation soaring, there has been speculation that the Federal Reserve would tighten monetary conditions even further to curb inflation. However, energy prices fell slowly, so there was an argument that BTC could receive a relief rally based on some of these other factors. There was an indirect correlation and now another report out on Friday could increase the chances of a Bitcoin recovery.

Retail sales report; Catalyst back to recovery?

The Federal Reserve’s CPI data and interest rate data have taken their toll on the market, but have been expected since the beginning of the year. Frankly, the market reacted in a way that was expected after a massive bullish rally in 2020-2021. Now a report indicative of the cooling of consumer demand is retail sales.

utilities, Retail are a good measure to evaluate the pulse of the economy and they can be used to understand market expansion or contraction. Now, rising retail numbers amid a booming economy is a good sign. It infers from this that shareholders of the retail companies realize higher profits. And lower retail numbers indicate a contracting economy.

However, it also translated into a decline in inflation. Now that comes across as contradicting the story above. As shown in the chart, retail sales saw a 0.8% drop in MoM from May to June. Now the June to July forecasts are coming out tomorrow, and another drop would mean people are spending less in a tumultuous time. While there is no direct correlation with Bitcoin here, it could underline that inflation could peak sooner rather than later.

Jonathan Silver, CEO of Affinity Solutions said: media outlet†

“The labor market remains strong, causing people to put money in their pockets; however, the price increases still exceed the wages of the people. Hopefully, this trend will reverse itself when inflation peaks and begins to decline. Our purchase spend data suggests this is the direction we are heading.”

At the time of writing, Bitcoin is actually on a recovery path and is currently above yesterday’s high. While not confirming a reversal, the release of CPI data may not have been as bearish for Bitcoin as expected.