Ethereum registered an attractive 12% pump over the weekend. From a local low of $1488, ETH rallied to $1,664. However, as soon as Asian markets began trading Monday, the alt registered a streak of 6 red candles every hour, translating into a 10% dip.

After hitting a low of $1498.95, Ethereum was consolidating again above $1500 at the time of writing. In the past few hours, ETH has tried to break past $1530 but has been rejected several times.

Ethereum Rejection Is More Than Coincidence For Asian Hours Dump

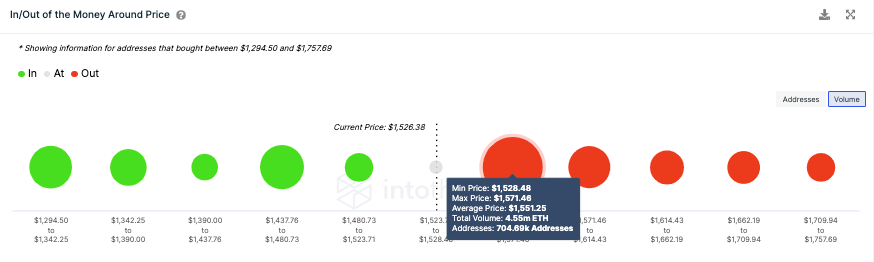

The current price band around which Ethereum traded has been a pretty attractive buying zone for HODLers in the past. As per ITB figures, from $1528 to $1571, as many as 4.5 million ETH tokens have been purchased. As illustrated below, Ethereum is facing the most powerful resistance here. And maybe that’s why it hasn’t gotten past the $1,530 psychological hurdle since morning.

So during the next few trading sessions, even if Ethereum rises, the said market participants [704.6k addresses] positions would gradually become profitable. As a result, they would be tempted to make a profit. And if the trigger is indeed pulled, the short-term woes of ETH would be extended into the medium term.

Lack of bullish thrust

Yesterday, Ethereum-related net flows in exchanges were positive [56k ETH], indicating that more participants sold and sent ETH to exchanges compared to those who bought ETH. Today buyers have amassed the dip and have a bit of the upper hand [negative flows of 14k ETH]. However, as illustrated below, the same is relatively lean compared to most other days, indicating the low bullish pressure being caused.

Additionally, it should be noted that crowd sentiment remains negative, paving the way for another Ethereum meltdown. Weighted sentiment was back in “severe negative” territory. The same indicates that market participants are not convinced that ETH will continue to rise. Claiming the same, one of Santiment’s recent tweets claimed,

“The trading public still doesn’t believe the hype and expects prices to fall…”

The number of short films also started piling up late, re-emphasizing the said story. According to Coinglass’s data, the ratio of long to short was <1 in 7 over the past 8 hours. So if the collective trader's outlook doesn't change, a drop to $1341, $1295 can be expected. If the micromarket condition deteriorates, and if the bulls fail to save ETH, the next $1062 will come into play. As economist trader Alex Kruger noted, "this would be a very" volatile week.”