Kolkata: India's two largest telecom companies, Trust Jio And Bharti Airtelhave seen sequential increases in their respective selling, general and administrative (SG&A) expenses in the fiscal first quarter, indicating a continued phase of intense competition to acquire and retain high-value customers, analysts said. More so, amid some SIM consolidation following the recent tariff hikes, they added.

Loss-making Vodafone idea (Vi), on the other hand, saw a sequential decline in SG&A spending in the second quarter. According to analysts, this is because the telecom company is using the recently raised money to initially improve the quality of its 4G coverage and thus limit customer losses.

However, analysts expect Vi to also get aggressive on the SG&A front in the coming quarters, especially as it improves 4G coverage in priority markets, rolls out 5G in key cities and aims to take on its larger rivals, Jio and Air Countin the battle for valuable customers.

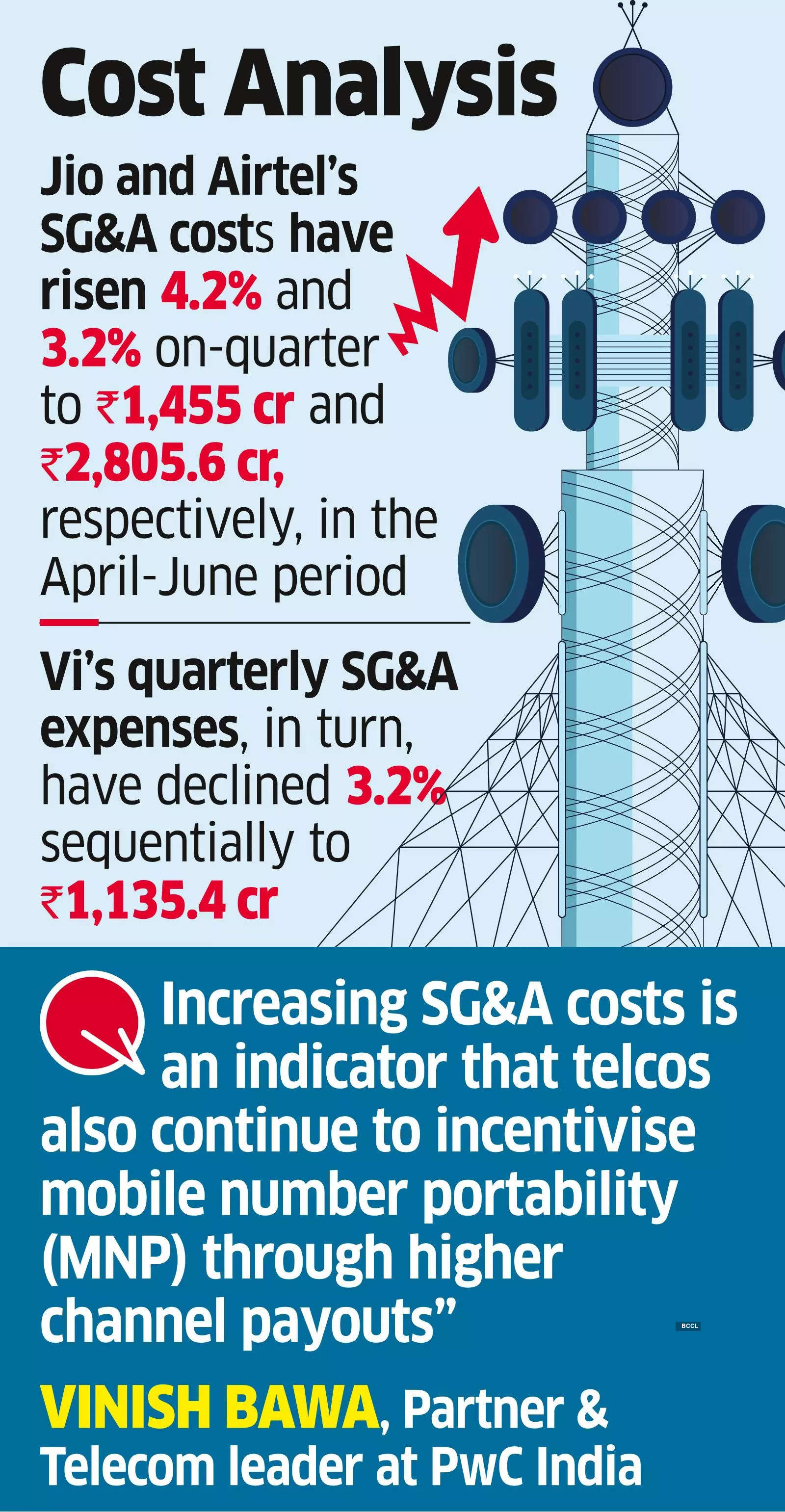

According to company data and estimates by ICICI Securities, Jio and Airtel's SG&A expenses rose 4.2% and 3.2% QoQ to Rs 1,455 crore and Rs 2,805.6 crore respectively in the April-June period. Vi's quarterly SG&A expenses, on the other hand, declined 3.2% QoQ to Rs 1,135.4 crore, company data and estimates by ICICI Securities IIFL effects estimates showed.

“The rising SG&A costs are an indication that telecom companies are also continuing to push mobile number portability (MNP) by charging higher channel fees,” Vinish Bawa, partner and telecom leader at PwC India, told ET.

According to analysts, SG&A expenses consist of sales and marketing (S&M) expenses, such as customer acquisition costs and advertising/promotion expenses, as well as other expenses such as content costs, bad debt provisions and miscellaneous expenses.

Another analyst at a leading global brokerage firm said Jio's higher sequential SG&A expense growth is partly reflected in stronger subscriber additions of 7.9 million, compared to 2.26 million for Airtel, while Vi lost 2.5 million customers.

However, industry executives said Airtel’s SG&A expenses are still almost double that of Jio as the Sunil Mittal-led telco’s premium branding and pricing strategy remain vital to acquire and retain high-value customers and sustain a higher average revenue per user (ARPU) compared to the telecom market leader. Airtel’s ARPU, a key performance metric, was almost 16% higher at Rs 211 compared to Jio’s Rs 182 in Q1FY25.