The past few months have been quite turbulent for the crypto market. Lately, however, most large-cap cryptos, including the leaders Bitcoin and Ethereum, are trading in the green.

In crypto-related investment products, most posted losses in June. However, in July the said trend reversed and most products posted positive 30-day returns.

Ethereum carries the torchlight

According to a recently published CryptoCompare Report,

“Ethereum-based products led the uptick in July, driven by price movements in the underlying asset.”

Early this week, ETH posted a 30-day return of 13.6%. In contrast, Ethereum-based products have posted gains ranging from 25.9% to 37.8%.

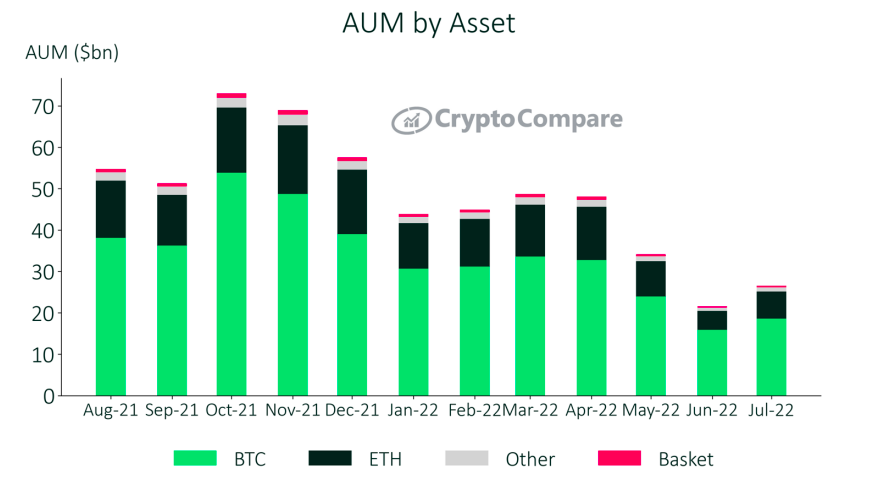

According to CryptoCompare, Ethereum’s cumulative assets under management rose 44.6% to $6.57 billion. Bitcoin’s assets under management, on the other hand, rose 16.9% to $18.6 billion. However, in the past month, Bitcoin’s market share has fallen significantly and currently stands at 69.9%, down from 73.6% in June.

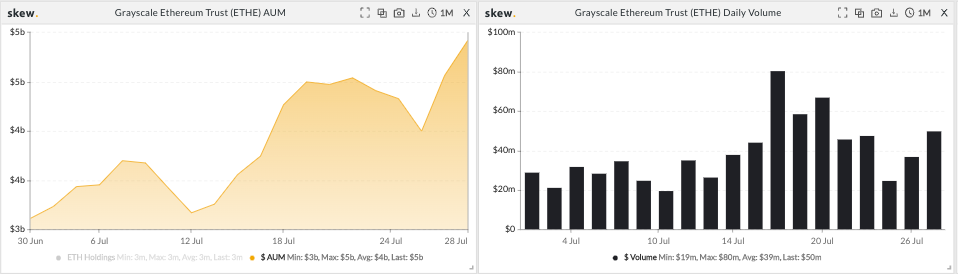

It’s a well-known fact that grayscale products still represent the vast majority of assets under management, as they account for $19.8 billion (74.4% of the total). As for Ethereum alone, the company’s managed ETH has risen from $3 billion to $5 billion in the monthly window. The volume of trust shares also improved significantly in the second half of July compared to the first half.

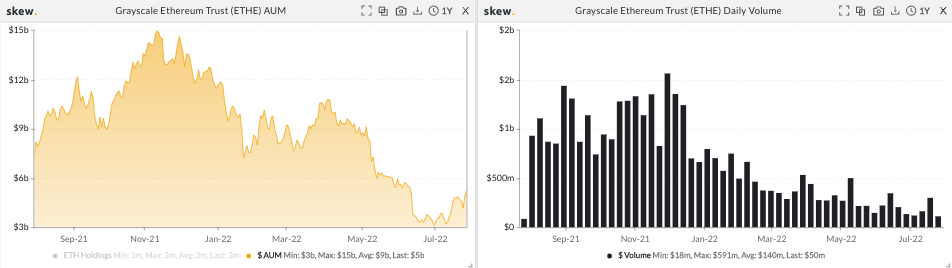

However, when zoomed out and viewed from the 1-year lens, the numbers remain malnourished. In and around the double-peak period last year, ETHE’s assets under management had grown to nearly $15 billion and volume to over $2 billion.

Well, we’ve been in a macro bear run since early this year. And all damage cannot be undone overnight. It is crucial to move forward one step at a time and considering the late mild recovery, it looks like we are moving in the right direction.

Also read: Ethereum breaks this 2018 record; Will it continue to rise?