Yesterday, Altcoin leader Ethereum was on an important $ 1,222 support line when the bear snuggled up. As predicted by yesterday’s Ethereum price analysis, after a failed retest, the Ethereum value pitted at $ 1,182 in a few hours and then stopped at $ 1,117 (see graph below).

ETH prices are once again at an important time. To be precise, the market is still bearish as we try to keep support at $ 1,117.70. Panic reoccurs and investors want to know if the bottom is down or if further price cuts are expected.

Let’s look at the metrics on the chain to understand the trader’s condition.

Ethereum shows weakness

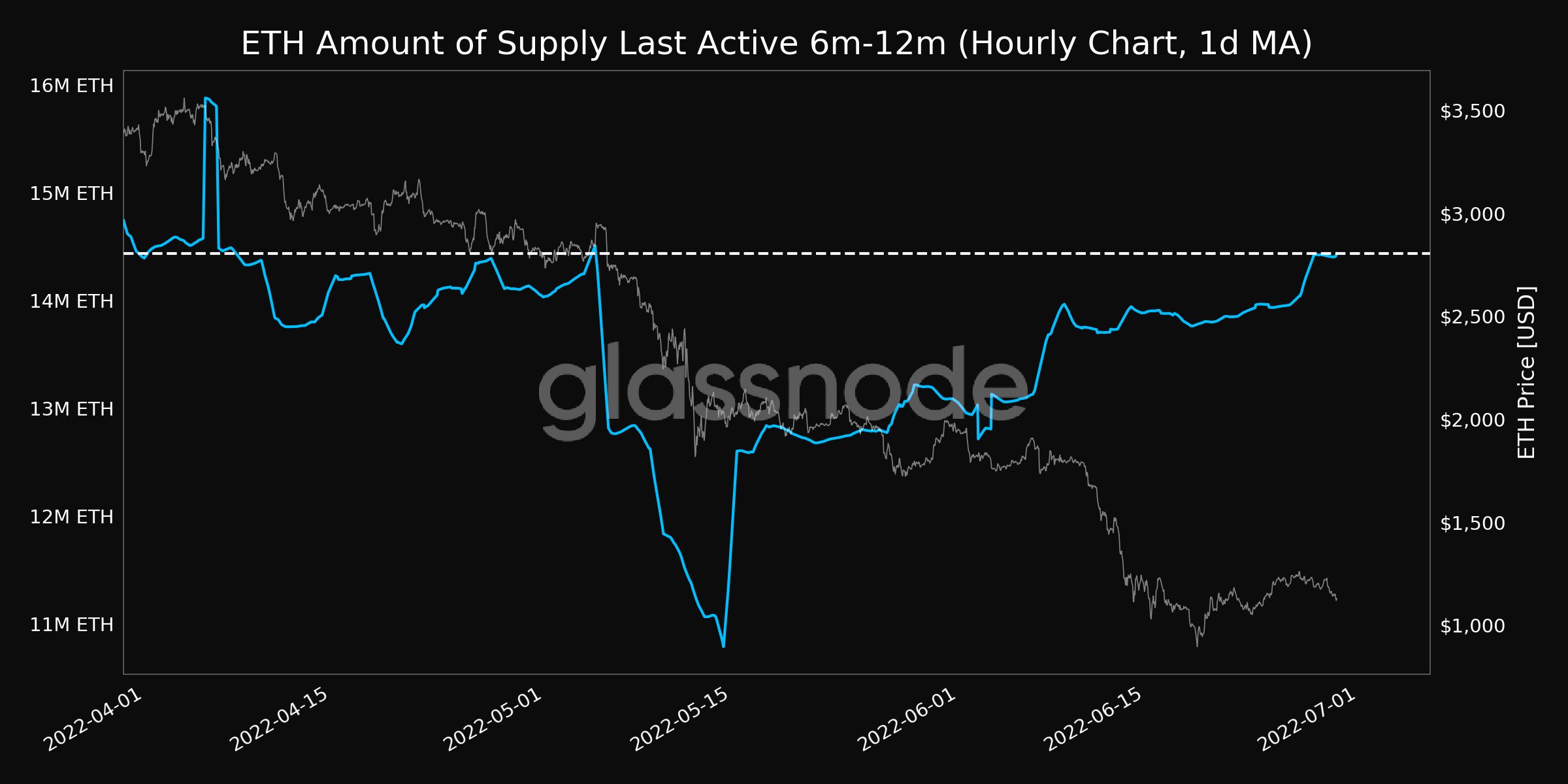

The data provided by Glassnode showed an increase in Ethereum supply activity that was last active between 6 and 12 months. The Glassnode alert noted that the above metric reached a monthly high of 14,433,873.497ETH.

This means that Hodler and traders were trading ETH as well than a month ago when the value of digital assets was over $ 1,800.

In addition, the exchange’s Ethereum balance has increased, reaching a three-month high of 21,581,770.924 ETH, showing more signs of sale.

In many cases, most long-term holders securely store their digital assets in an external wallet. However, given price volatility, it is possible that some of the ETH has been transferred to the exchange in case another sold out is triggered.

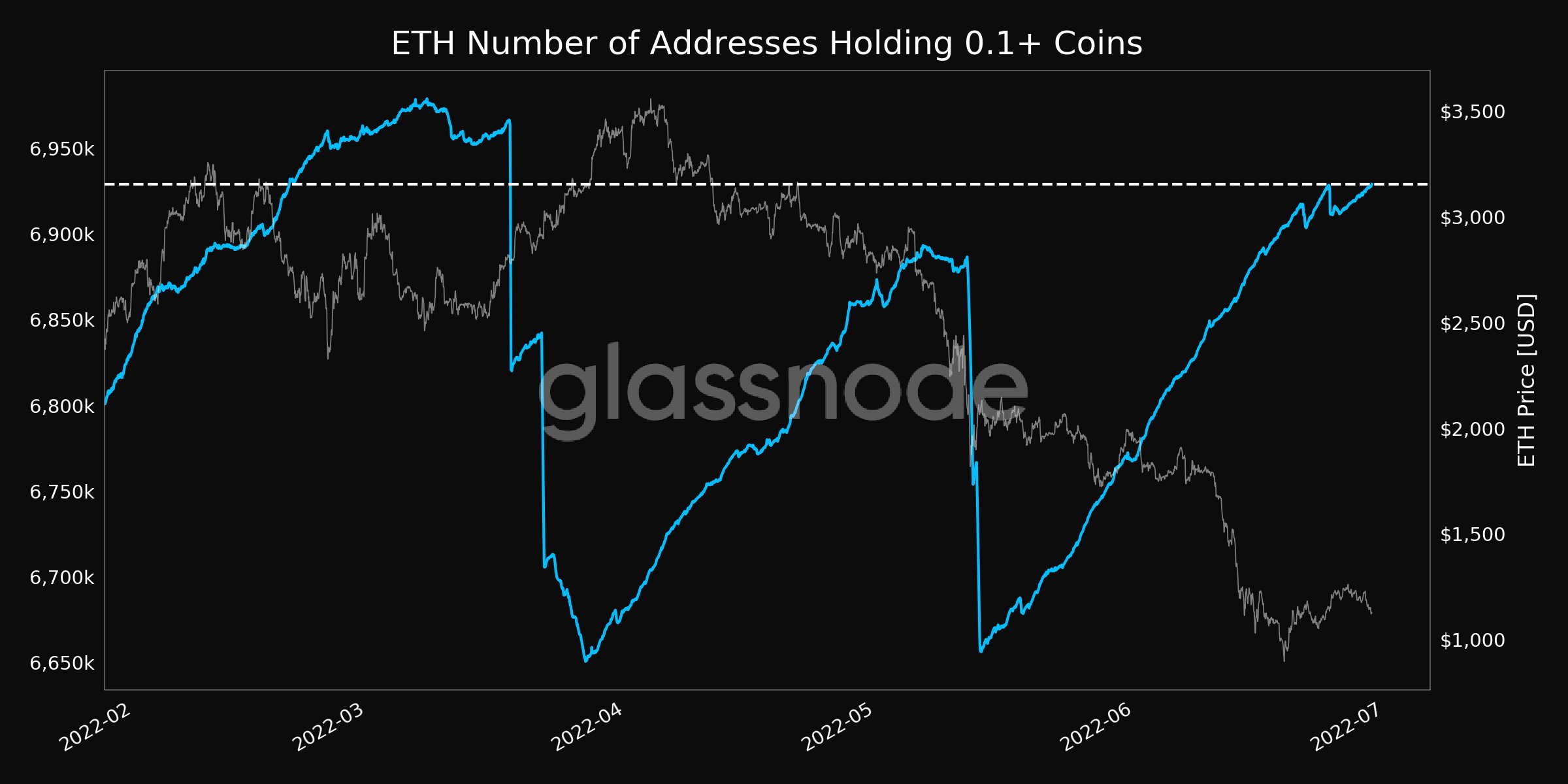

But that wasn’t a bad scene for traders, especially investors waiting on the sidelines to buy more ETH. As the ETH value remained low, the number of non-zero addresses increased, reaching a record high of 83,076,411. On the other hand, the number of addresses holding at least 0.1 coins reached a maximum of 6,929,126 in three months.

Short-term future

At the current price level of Ethereum, sales pressure is high. If the bear decides to attack this level again and destabilize the price, ETH could go directly to the buying zone between $ 1,065 and $ 1,041.

The chart above highlights the lack of support between $ 1,117.70 and $ 1,065.03. If ETH plunges into the buy zone, there may be more activity from traders. This trend can occur over the weekend as ETH closes another quarter, and traders need to be aware of these levels.