The US-headquartered company said when announcing its fourth-quarter 2022 earnings that Vi had communicated in early 2023 that “it would not be able to resume payments in full and would instead continue to make partial payments.” It said that ATC “has considered these recent developments and the uncertainty regarding amounts owed under its tenant leases when conducting annual impairment assessments for long-lived assets and goodwill in India, and as a result issued a negative affected the tenant-related intangible assets for Vi, resulting in an impairment loss of $411.6 million.”

The tower company also took an additional $97 million (Rs 795 crore) write-down on intangible assets of towers and network locations in India. However, it did not reveal whether this was also related to the uncertainties surrounding contractual payments from cash-strapped Vi.

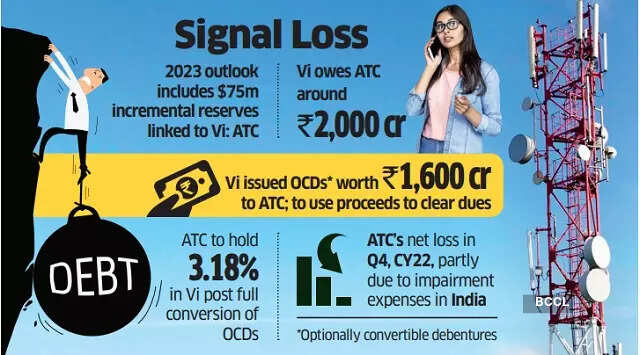

Further, ATC said that the company’s outlook for 2023 includes approximately $75 million (Rs 615 crore) incremental reserves related to India’s Vi, which will increase the adjusted funds of operations (AFFO) attributable to the common shareholders of the company. business per share, with $0.16 to be dragged away.

ATC posted a 10.6% year-over-year revenue increase to $2,705 million for the quarter ended December 2022, but reported a net quarterly loss of $717 million, partly driven by impairment charges in India.

ET’s questions to ATC went unanswered at the time of going to press.

At the end of February, Vi was assigned convertible bonds (OCDs) worth Rs 1,600 crore ATC Telecom Infrastructure Pvt Ltd (ATC-TIPL), a subsidiary of ATC. The proceeds will be used to settle the US tower company’s dues. Vi owes ATC an estimated Rs 2,000 crore.

ATC-TIPL will hold 3.18% in the telco, assuming full conversion of the OCDs issued, while Vi’s promoters will own 48.76% – Vodafone in the UK 31.27% and Aditya Birla Group in India 17.49% – at the telco. The government will hold 32.09% in Vi.

At Vi’s December quarterly earnings report last month, chief executive Akshaya Moondra had said the loss-making telco must first get financing to make investments and improve its operating cash flows before addressing the supplier payment situation. Vi, he had said, would not be able to begin clearing supplier rights until enough cash was generated from operations.

Vi is also facing cleanup issues due to more than Rs 7,000 crore from another tower company, Indus Towers. The carrier’s cash balance was Rs 160 crore as of 31 December 2022, while net debt was about Rs 2.22 lakh crore, including deferred spectrum payment obligations of about Rs 1.39 lakh crore and adjusted gross receipts (AGR) liability of Rs 69, 910 crore.

However, Vi’s suppliers have recently become more optimistic about the company’s chances of survival, especially after the government converted the telco’s accrued interest into equity, which is expected to open the doors to refinancing some of Vi’s bank debt. That, coupled with an expected Rs 5,000-crore equity infusion into the telco by its promoters, is expected to lead to third-party funding.

This is essential for much-needed investment in Vi’s 4G network, the roll-out of 5G, and also sufficient cash generation from the business.

Vi’s net loss in the December quarter rose sequentially to Rs 7,990 crore dragged by higher financing and operating costs as it continued to see heavy subscriber losses. The revenue for the October-December period was sequentially tied at Rs 10,620.6 crore.