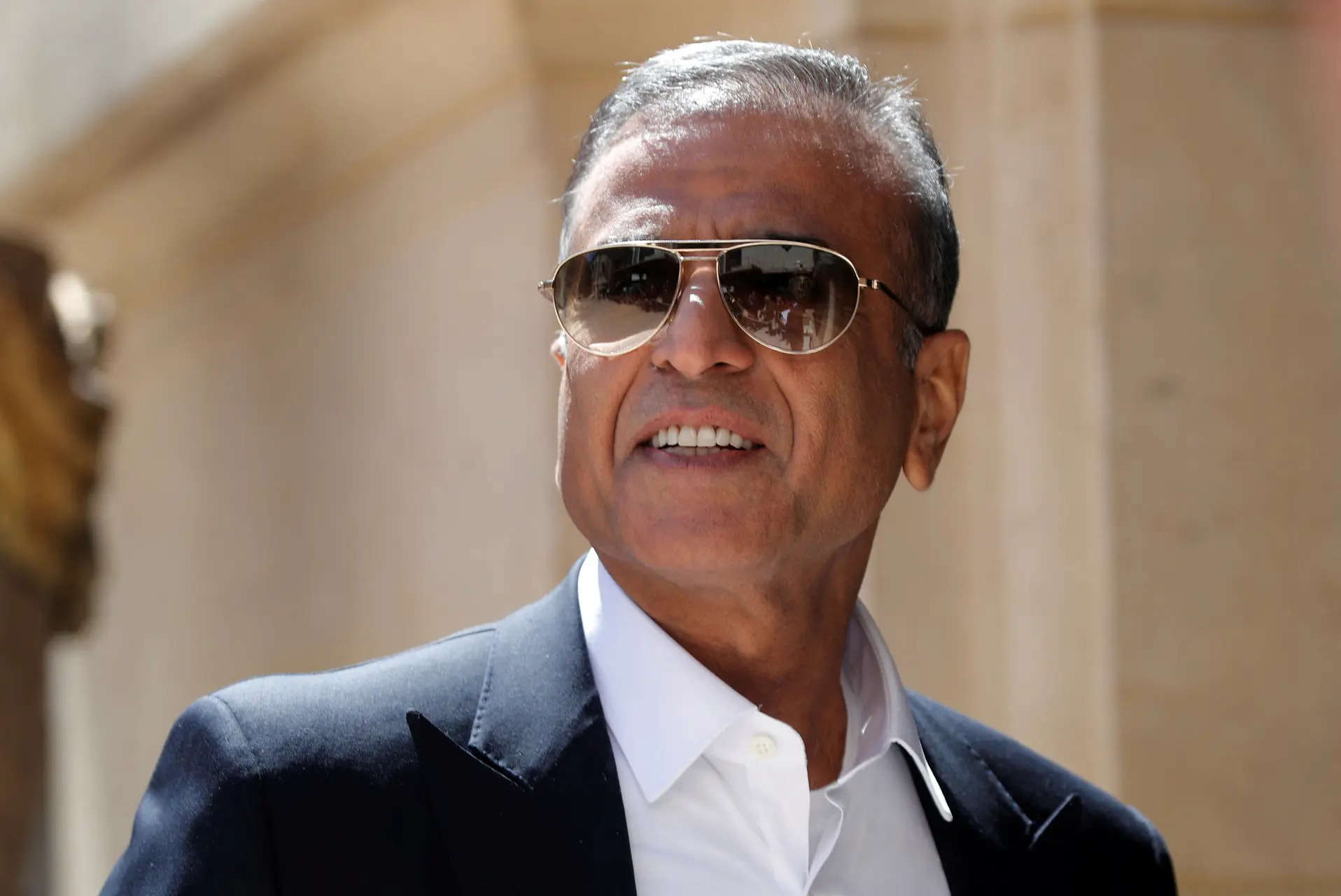

ARCHIVE PHOTO: Sunil Bharti Mittal, chairman of India's Bharti Enterprises, arrives at the “Tech for Good” summit in Paris, France, May 15, 2019. REUTERS/Charles Platiau/File photo

ARCHIVE PHOTO: Sunil Bharti Mittal, chairman of India's Bharti Enterprises, arrives at the “Tech for Good” summit in Paris, France, May 15, 2019. REUTERS/Charles Platiau/File photoBharti Group has raised approximately $1.8 billion from Barclays for the proposed acquisition of a 24.5% interest in the United Kingdom BT Groupaccording to people familiar with the development. A group of international banks could consider providing additional financing depending on the group's need for more debt for the deal, they said.

The acquisition of a 9.99% stake in BT through open market trading is being done by Recruitment worldwidethe international branch of Bharti Companies, through Bharti Televentures. The remaining 14.51% will be acquired after receiving regulatory approval.

Bharti buys stake from BT's largest shareholder, Altice VK. BT shares have risen more than 10% this week to a market capitalization of $18.55 billion after the share purchase was announced. Depending on the valuation for the acquisition, the group will seek to inject a mix of cash and debt for the remainder of the deal, which could take some time, the people cited said, adding that a final decision on the additional debt amount will then be made.

A Bharti spokesman declined to comment on the matter. International banks are happy to lend money for five years based on the holding company's strong fundamentals, the people familiar with the matter said.

“A subsidiary of BEHPL {Bharti Enterprises (Holding)}, Bharti Enterprises Ltdhas incurred external debt against which it will have adequate liquidity, resulting in a negligible net debt position,” credit rating agency ICRA said in March.

The external debt of Bharti TelecomBharti Airtel's holding company, was Rs 24,950 crore as on March 20, against which the market value of investments stood at Rs 2.75 lakh crore, indicating a healthy buffer, the rating agency said. BEHPL is the majority shareholder of Bharti Telecom.

While the matter is still at an early stage, there could be a potential issue with the pricing of the remaining loan and the spread over the secured overnight funding rate (SOFR), based on initial discussions between banks and Bharti, said one of the people cited earlier, who asked not to be named.

“The spreads above SOFR that are being discussed are very tight given the financing conditions in the global market,” the source said.

SOFR is a benchmark rate used to price dollar-denominated loans. Bharti Group said in a statement earlier this week that it does not plan to bid for control of Britain's largest broadband and mobile company. It also does not seek a board seat, chairman said Sunil Mittal he told the media at the time.

“The financing is being done by Bharti Global… Barclays was the financial advisor for this transaction and they provided cash directly,” he said. Mittal said he expects the deal to close in the coming months.