Alt headline: Bitcoin and Ethereum miners get some relief; But will it help?

The current crypto winter is the coldest yet. Crypto prices have fallen more than 50% this year. In addition, Bitcoin (BTC), the original cryptocurrency, had its worst-performing quarter in the second quarter of 2022. Ethereum has also fallen victim to the cold. The second-largest cryptocurrency by market cap has failed to reach $1.3K, a level that many have their eyes on.

In addition, miners have suffered as a result. When electricity costs rose and the value of Bitcoin vice versa, many miners started selling their assets at discounted prices. Shares of Crypto mining companies also deteriorated as the cold became too much to bear.

However, new data shows that the cost of producing Bitcoin has fallen.

Bitcoin Miners Get Some Relief, But What’s The Downside?

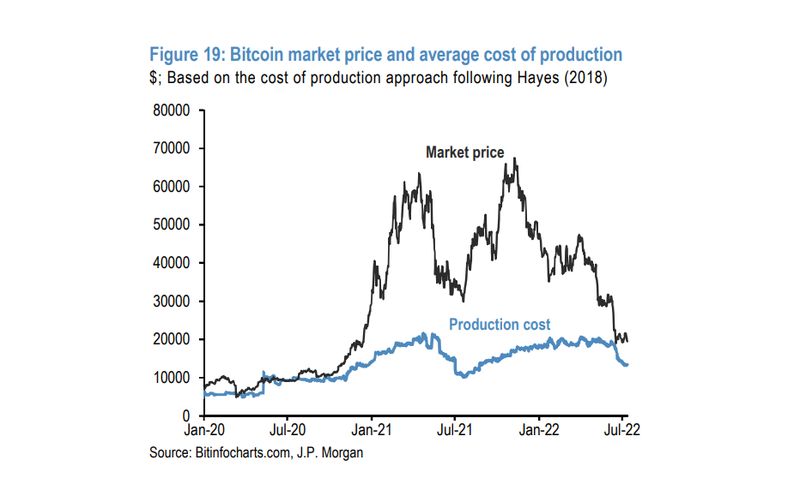

According to J.P. Morgan Chase & Co. the cost of producing one bitcoin has dropped from about $24,000 in early June to about $13,000. According to the Cambridge Bitcoin Electricity Consumption Index, the cost decrease is due to a decrease in electricity consumption. Miners are doing their best to maintain profitability and switch to more energy efficient rigs. The study does not think the price drop is due to efficient miners leaving the industry. Nevertheless, they believe that this development could act as a barrier to an increase in the price of BTC.

The strategists behind the study wrote:

“While it clearly boosts miner profitability and potentially eases the pressure on miners to sell Bitcoin holdings to increase liquidity or deleverage, the decline in production costs could be viewed as negative for the future price outlook of miners. Bitcoin.”

In a bear market, some players believe that the cost of production represents the lowest limit of the Bitcoin price range.

How are Ethereum miners doing?

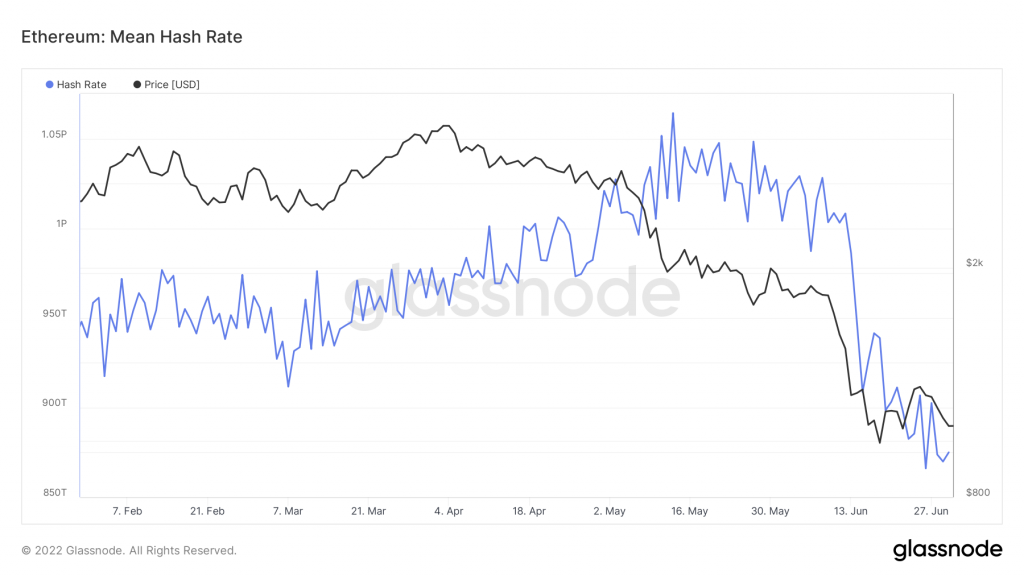

In June, Ethereum miners’ earnings fell to $498 million, which was alarming. The drop in revenue is attributed to Ethereum’s move to a Proof-of-Stake (PoS) consensus method. PoS will make mining obsolete, and many miners are afraid of going out of business once “the merger” is underway.

When profitability declined, ETH miners withdrew from the system, leading to a drop in hash rate.

At block 15,050,000, the Ethereum network received a scheduled update to change the difficulty bomb settings. On June 30, the Gray Glacier upgrade went online, delaying the difficulty bomb by about 100 days. A rapid spike in mining problems has been called Ethereum’s “difficulty bomb”. This is done to deter miners from using the proof-of-work algorithm after moving to proof-of-stake.

The 100-day delay provides some relief for ETH miners, but it is only a temporary move.

At the time of writing, Bitcoin trade at $20,552.75, up 2.1% in the past 24 hours. At the same time, Ethereum trade at $1,194.63, up 7.8% in the past 24 hours.