AppleInsider is supported by its audience and can earn commissions as an Amazon Associate and Affiliate on qualifying purchases. These partner relationships do not affect our editorial content.

Apple once again exceeded Wall Street’s expectations, despite a difficult macroeconomic environment and supply chain problems. Here’s what analysts were thinking after the call and how earnings compare to pre-pandemic Apple.

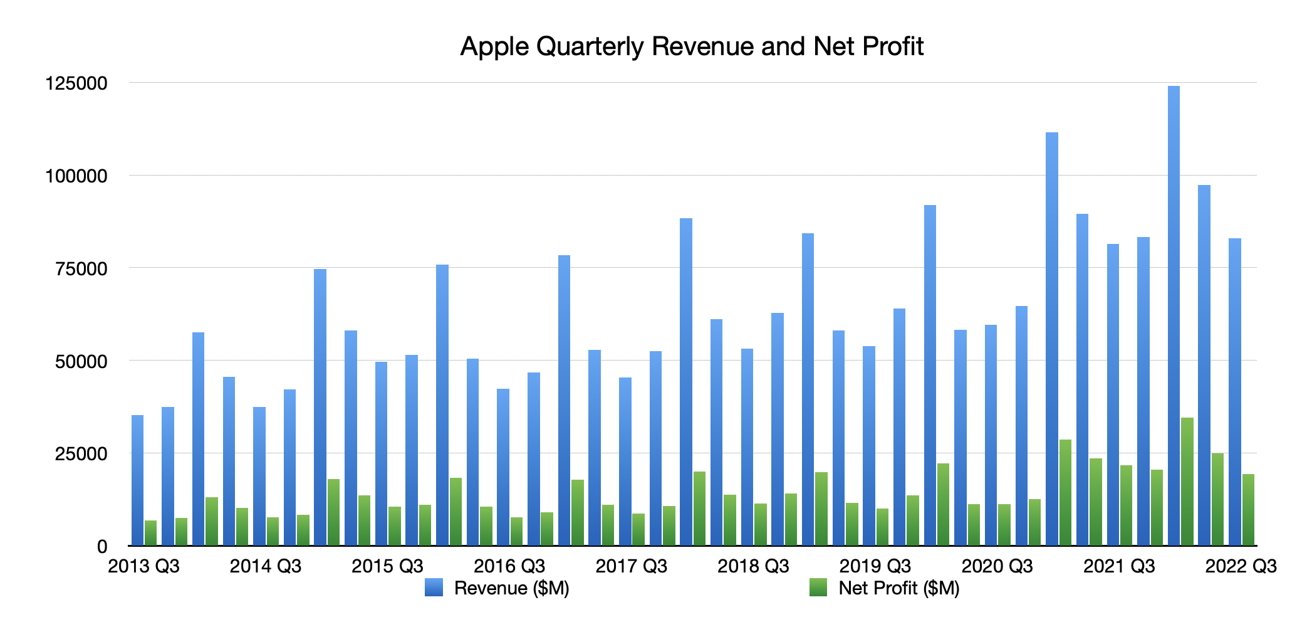

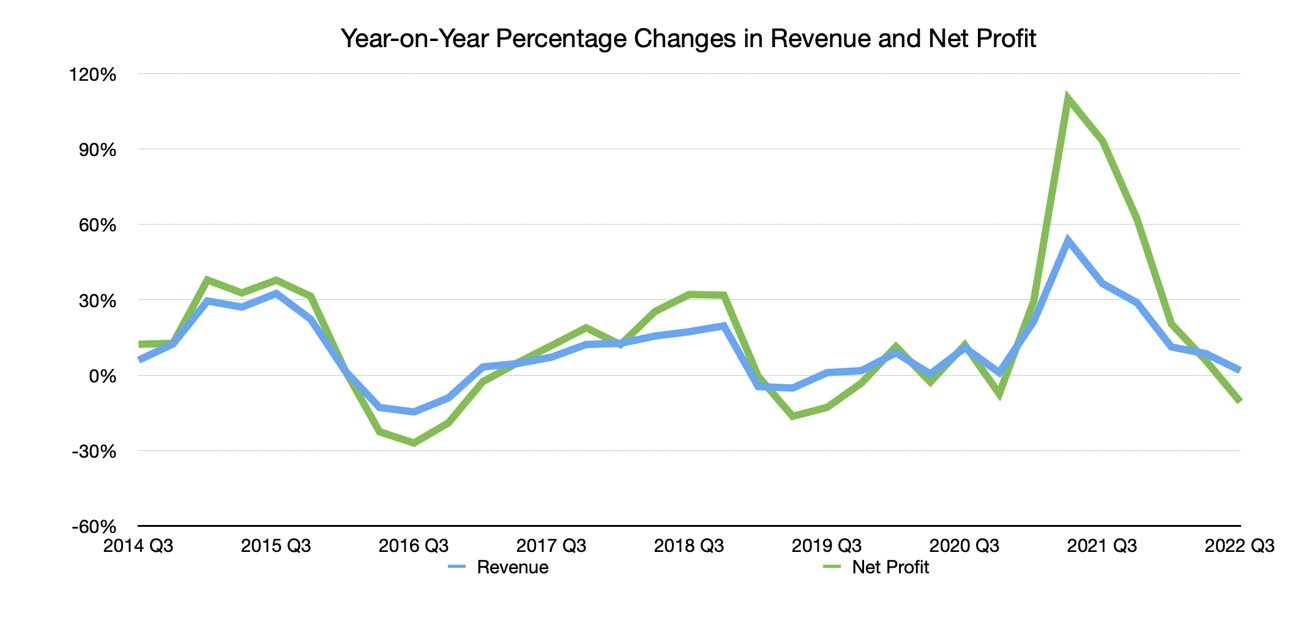

The iPhone maker reported $83 billion in revenue, up 2% year over year. The company’s third quarter 2022 revenue was also slightly ahead of the Wall Street consensus, which was closer to the $81 billion to $82 billion range.

Although Apple’s third quarter 2022 revenue was only 2% higher than the quarter a year ago, it was still record revenue and the Cupertino tech giant’s best June quarter to date.

Net profit declined slightly to $19.4 billion from $21.7 billion in the third quarter of 2021.

Importantly, the supply headwinds that Apple warned about earlier in 2022 came in lower than expected. Apple had warned of a $4 billion to $8 billion revenue drop due to ongoing chip shortages and Covid-related lockdowns in China.

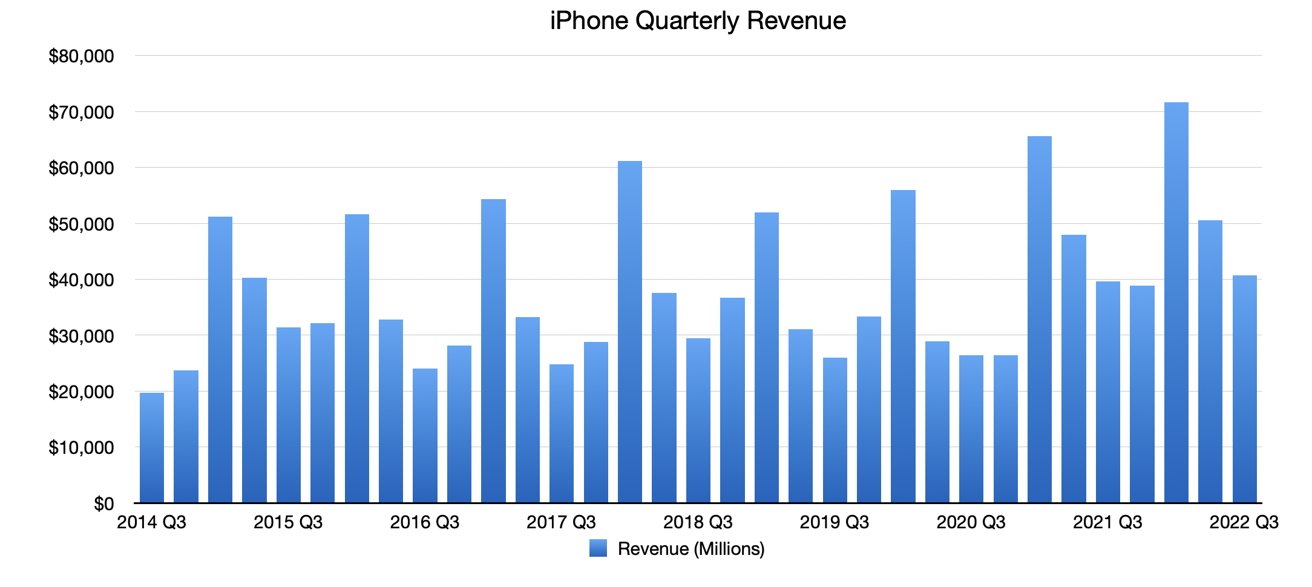

Apple’s iPhone maintained its revenue dominance in the June quarter, with revenue of $40.6 billion, compared to $39.5 billion in the third quarter of 2021.

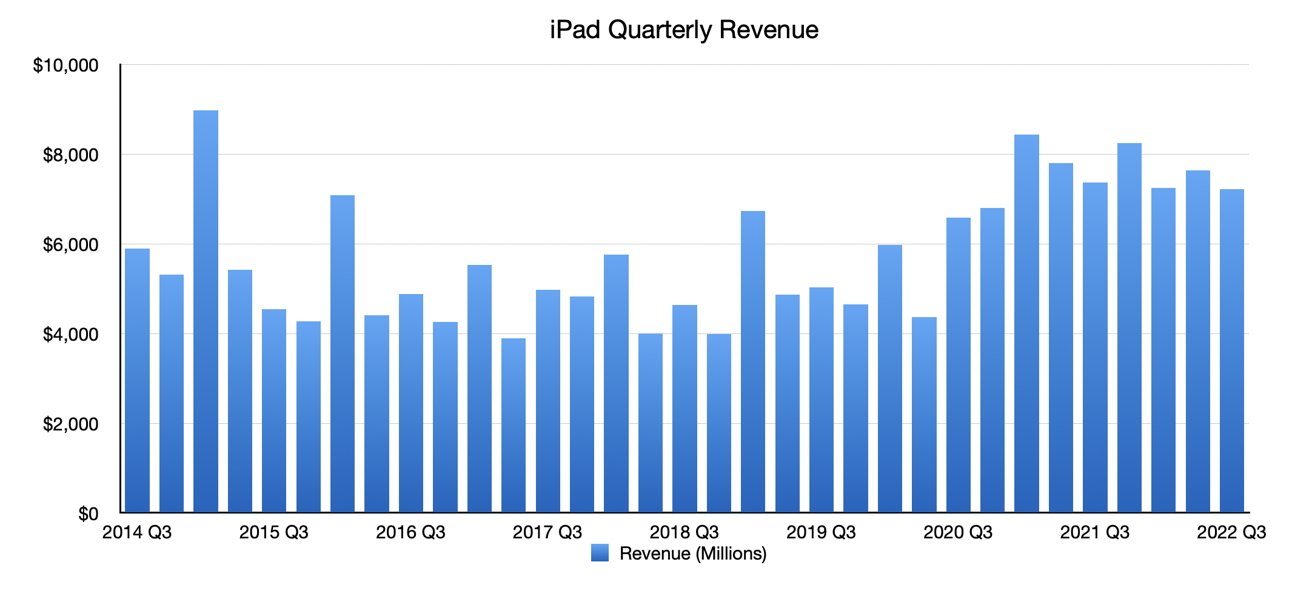

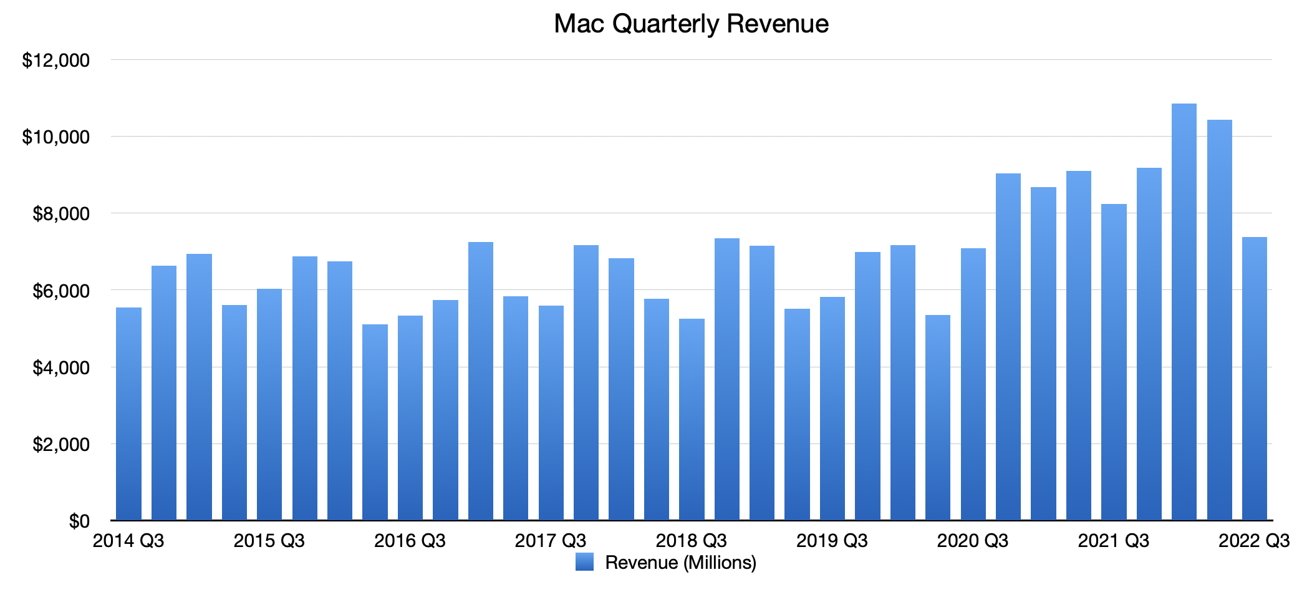

The company’s other products, including the mac and iPad — were hit harder by chip constraints and delivery issues.

The iPad fell to $7.2 billion in revenue, just a slight drop from $7.3 billion in Q3 2021.

Apple’s Mac category fell to $7.3 billion in revenue, from $8.2 billion in the year-ago quarter.

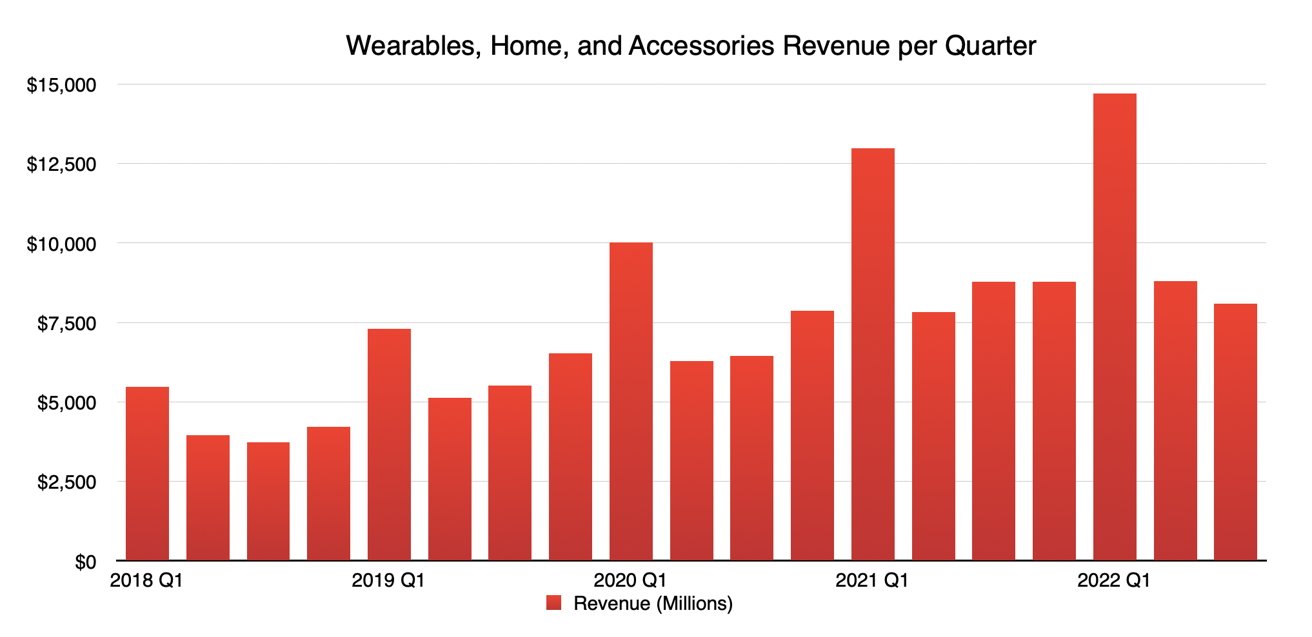

In Wearables, Home and Accessories, Apple saw revenue of $8.08 billion in the third quarter of 2022. That’s less than the $8.7 billion the category earned in the third quarter of 2021.

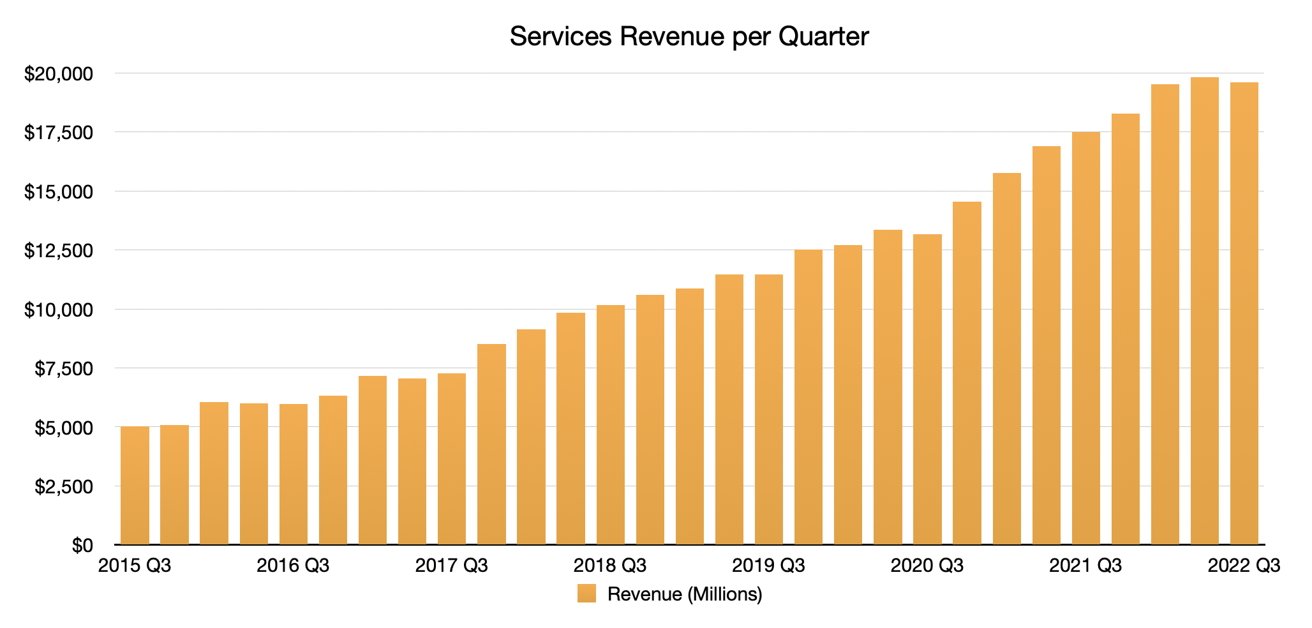

Services continued to be a strong revenue driver. The category brought in revenue of $19.6 billion during the quarter, up $17.4 billion year-over-year.

Here’s what analysts thought about Apple’s better-than-expected performance.

Samik Chatterjee, JP Morgan

Samik Chatterjee, principal analyst at JP Morgan, has left his revenue and earnings forecasts largely unchanged after Apple’s solid June quarter performance.

The analyst believes Apple remains a safe haven investment, especially as iPhone revenue continues to grow and Services maintains its position as a predictable and resilient measure of revenue and earnings for the company.

Chatterjee maintains its 12-month Apple price target of $200.

Dan Ives, Wedbush

Wedbush analyst Daniel Ives believes Apple made a appearance in “Top Gun Maverick Fashion” in the June quarter. Ives believes the results will be a focus of attention among tech industry viewers, and is a “big positive” for Cupertino and beyond.

Ives also spent time focusing on Apple’s performance in China. The company earned $14.60 billion, just a slight drop from $14.76 billion in Q3 2021, despite Covid shutdowns and other restrictions. He believes Apple is well positioned to take advantage of a strong installed base over the next six to 12 months.

The analyst maintains Apple’s 12-month price target of $200.

Harsh Kumar, Piper Sandler

Harsh Kumar of Piper Sandler believes Apple’s results are impressive, and emphasizes the fact that Apple believes its other revenue growth will accelerate in the September quarter.

Kumar also sheds light on the fact that the current macroeconomic environment has had “no meaningful impact” on Apple’s iPhone revenues. Apple also set an installed base record, which Kumar says is a testament to brand loyalty and the company’s strong performance.

The analyst maintains Apple’s 12-month price target of $195.

Erik Woodring, Morgan Stanley

According to Morgan Stanley’s Erik Woodring, Apple’s iPhone and Services segments were more than enough to offset quarterly weakness in the iPad and Mac categories. Overall, he admits that Apple’s quarterly results in June were better than he expected.

The analyst has not changed its estimates for the September quarter and believes Apple’s relatively conservative outlook is justified given the macro environment. He also points to Apple’s gorse margins of 43.3%, which beat his forecast by 80 basis points and management’s expectation of 30 bis points.

Woodring maintains Apple’s 12-month price target of $180.

Gene Munster, Loup Ventures

Gene Munster, an analyst and partner at Loup Ventures, believes Apple is “defying gravity and weathering the early stages of the macroeconomic downturn.” He attributes the company’s strength to the iPhone, which he says is now an essential product, not a luxury item.

Looking more broadly, Munster believes that Services growth was essentially in line with expectations and that Mac’s headwinds will be temporary. Going forward, he believes Apple’s upcoming stacked lineup — which could include health, AR/VR, and other products — will be positive for the company’s multiplicity in the coming years.

Munster maintains its 12-month Apple price target of $250.

Krish Sankar, Cowen

Krish Sankar highlighted Apple’s upside and strong performance during the June quarter – and its strong iPhone earnings despite a shaky economy. Sankar points out that Apple’s performance was driven by supply chain concerns and smartphone weakness.

Going forward, the analyst believes Apple will benefit from reducing supply shortages in the September quarter. While the macro environment is providing some modest headwinds for Services, he still believes the company will continue to grow in the long term.

Sankar maintains Apple’s 12-month price target of $200.