New Delhi: influx of affordable 5G handsets average weighted smartphone prices in India in the quarter ended March, halting a 12-quarter price increase. Average sales prices (ASP), an indicator of how much people pay for their mobile phones on average, remained flat at $263 sequentially in the first quarter, according to market research firm IDC India.

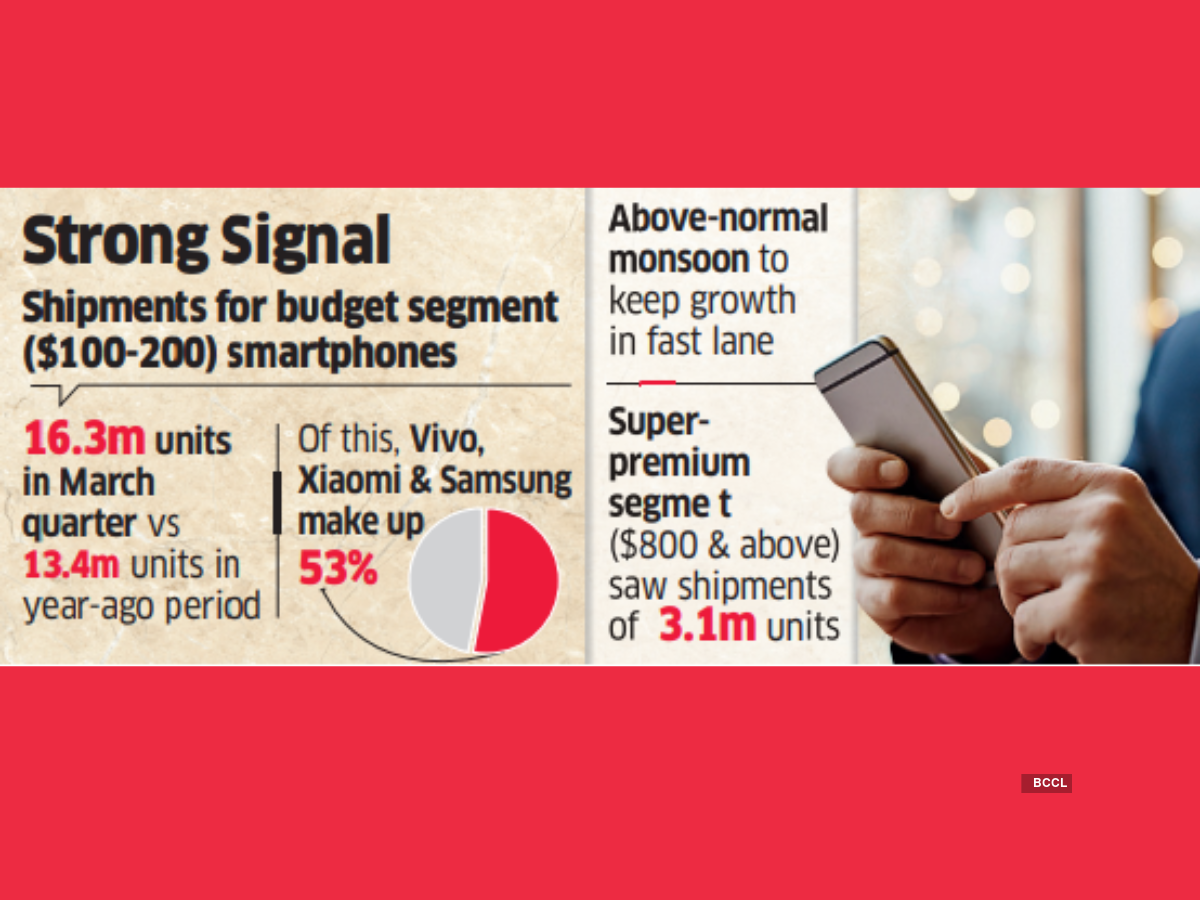

This follows a double-digit increase in ASPs over the past three years, amid growing demand for higher-end handsets since the pandemic. The flat ASP in the March quarter was largely due to a 22% year-over-year increase in shipments of mass budget phones priced at $100-200 at 16.3 million units, compared to 13.4 million units a year earlier, which marks a revival compared to previous quarters.

“The mass budget segment $100-200, which holds the majority share, declined but rebounded in early 2024 with affordable 5G supply and is expected to remain flat or grow in the coming quarters,” said Upasana Joshi, senior research manager at IDC India.

The launch of many new 5G-enabled models fueled growth in the mass budget segment, with brands and consumers beginning to leverage the 5G rollout by Bharti Airtel And Trust Jio. said IDC Living, Xiaomi and Samsung accounted for 53% of this segment's shipments in the quarter. “Honestly, we're number one when it comes to value growth In the overall market, a lot of attention is being paid to driving volumes and identifying those segments where the opportunities for upgrade are greatest,” said Raju Pullan, senior vice president, mobile entrepreneurship, Samsung India.

He said the Rs 20,000-30,000 segment is currently outpacing all others and growing at around 60% annually. Pullan added that Samsung will also focus on this Entry-level 5G phones to help the upgrade by 4G users, in addition to offering 4G devices in the mass segment where it continues to see growth opportunities.

“We will have 4G models; we will also have a stronger portfolio of entry-level 5G devices this year. Our focus will not only be on value, but also on volumes.”

According to IDC India, the mass budget segment was the largest contributor to the smartphone market in terms of volume, impacting ASPs. This despite the continued expansion in the US super-premium segment ($800 and up) at 3.1 million units in the first quarter of 2024, compared to 2.1 million the year before. Counterpoint Research noted that ASP growth has been flat at 10% year-on-year over the past three quarters, reaching $298 in Q1 2024, coinciding with the flood of affordable 5G handsets in the Rs 10,000 price segment -20,000 since the second half of 2024. 2023.