Accompanying the FOMC meeting’s rate hike announcement and the Fed chairman’s claims that the US is “not” in recession and the economy is on track to grow this year, markets rose across the board. Well, a 75 BPS walk isn’t technically a healthy sign. However, analysts and market participants expected the same. So the Fed just delivering was not causing chaos in the markets. Additionally, as similar back-to-back hikes have been highlighted in green in recent months, the turnout didn’t necessarily feel new/significant this time around.

More importantly, so does Powell claimed that at some point it will be appropriate to slow down interest rate hikes. According to renewed analysis, analysts are looking at an increase of 50 BPS and 25 BPS in September and November, respectively. It is clear that the glimmer of optimism that has flared up has been well received, and investors have gradually started to become forward-looking. While the Nasdaq 100 posted its best one-day gain since November 2020 and the S&P 500 also traded in the green, the crypto market was trading—as speculated last week– follow the. And again this time, instead of Bitcoin, the show was run by Ethereum.

Rallies galore after interest rate hike, but for how long?

While Bitcoin is up 9% in the past 24 hours, Ethereum is up 13% in value. Aside from the macro factors mentioned above, the token price surge had full network support this time around.

For example, Ethereum’s active addresses noticed a huge spike yesterday and eventually created a new ATH. Santiment revealed that 1.06 million ETH addresses transacted yesterday, eclipsing the January 2018 record of 718k.

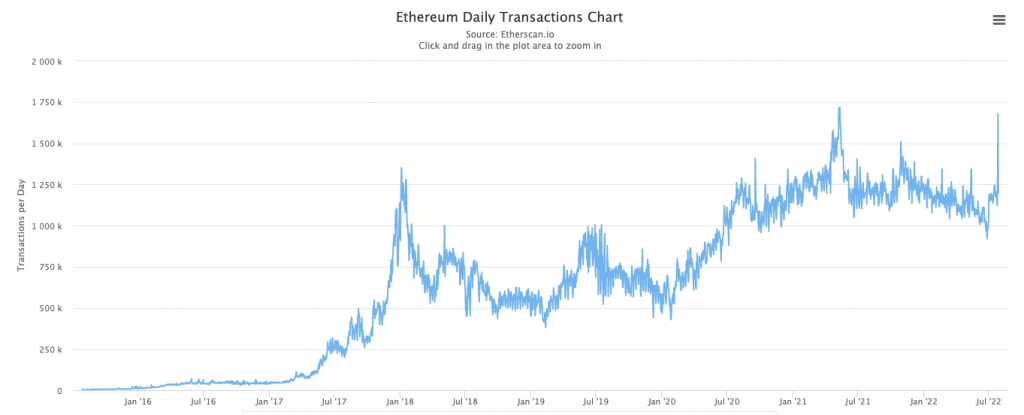

The peak in the number of active addresses did translate into a peak in the number of daily transactions. The same essentially brought it to nearly the same level as the levels recorded in May 2021, before the flash crash.

At the same time, it is interesting to note that Ethereum’s N/A ratio has also reached a new high in one month. The same indicates that the network value can overshadow the value transferred on the network and is an indication of the actual network growth.

Increasing network activity, in most cases in the recent past, has helped the network’s token rally. So, will the same help this time also help extend ETH’s short-term bull spree?

Ethereum’s Pump Is Likely a Bulltrap

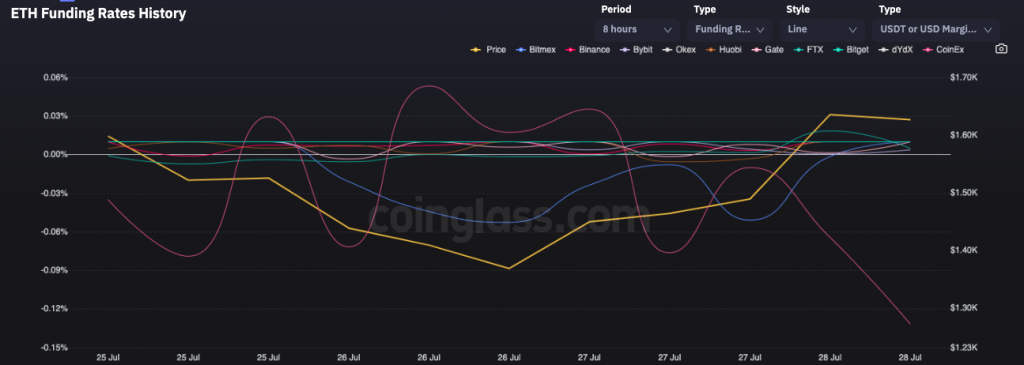

Collective trade sentiment is not very optimistic at this stage. The funding curves of the most prominent exchanges are already beginning to point south, indicating weak bullish momentum. On CoinEx, the price even recorded an unusual dip to -0.13%. Collectively, they suggest that the market is slowly starting to dump bulls.

In addition, the long:short ratio also hovers below one, around 0.8 lately, indicating that short Ethereum orders are piling up relative to the lungs. The same further suggests that traders expect ETH’s overheated price landscape to cool down.

So, taking into account the data sets mentioned, it is likely that the recent pump is a bulltrap and the Ethereum market is poised for a correction. However, the improved network-related fundamentals would not be in vain. They will eventually play a role in refining the long-term price of ETH.