Ethereum’s EIP-155 upgrade went live last year. The improvement proposal significantly changed Ethereum’s monetary policy and introduced the entire combustion mechanism.

After the upgrade, although the burning was implemented, the price of ETH did not immediately react to it. All the more so because the release was higher than that of the burn rate. However, on a number of occasions where the burn rate has accelerated, ETH has noticed slight increases in illumination at the same time. At the moment, however, things are going a bit rough.

Ethereum burn rate at an ATL

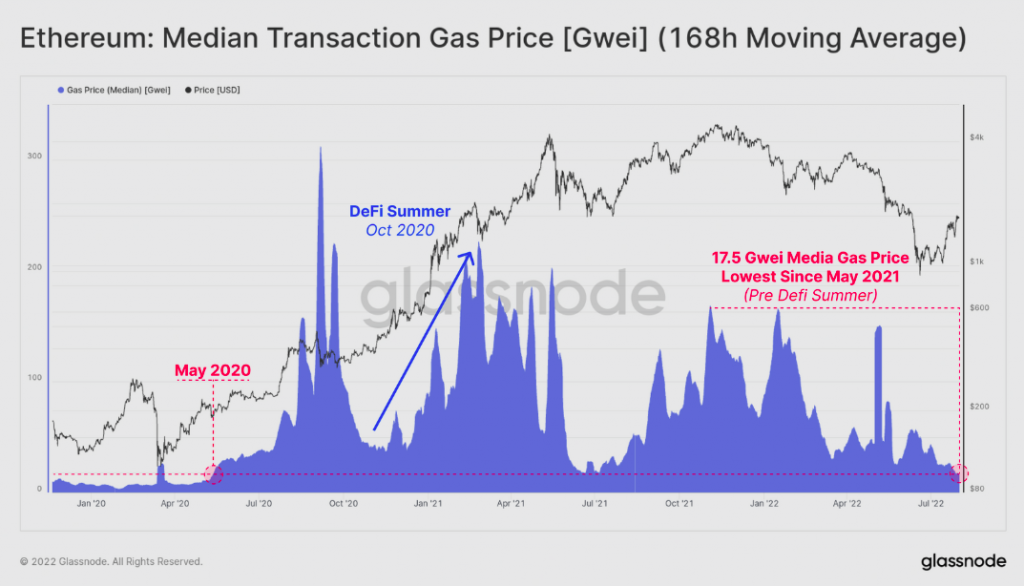

Before we get into the burn rate, it’s essential to note that Ethereum gas prices have fallen to around 17.5 gwei. As can be seen in the chart below, this is the lowest network congestion and gas price since May 2020. A low gas fee usually means that fewer people are using the network and vice versa. Continuing with the current state, Glassnode’s latest weekly report noted,

“This indicates that despite recent positive price action, there has been no influx of new uses, and overall Ethereum is at a multi-year low in relative activity.”

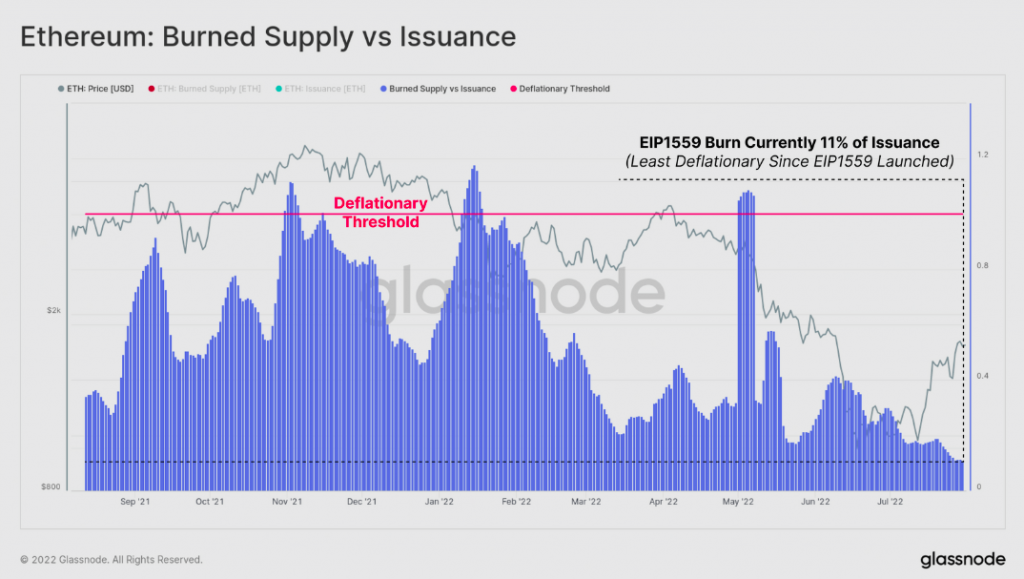

Here it is essential to note that with every transaction on the network a small amount of ETH [the base fee] is removed from the circulation through combustion. Burn speed has increased and network usage remains low.

As shown in the chart below, the ETH burn rate through EIP1559 is currently at an all-time low, implying that ETH is the least deflationary since last year’s upgrade went live. Glass node revealed,

“The total amount of ETH burned is now only 11% of the total issuance.”

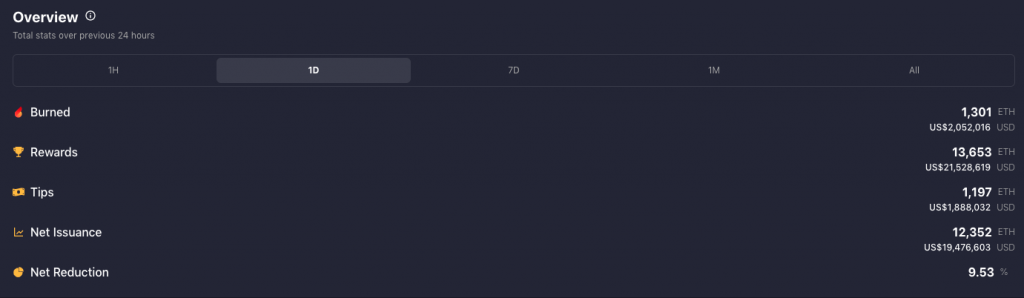

The situation remains moderate. According to the latest data from Watch The Burn, only 1301 ETH tokens were burned in the past day, compared to the 12,352 tokens put into circulation. As a result, the net reduction at the time of going to press was only 9.53%.

Price implication

Well, the current state of incineration and issuance indicates that the circulating supply is increasing, making the landscape unfavorable to the price increase. Market participants have also sold their tokens, adding fuel to the fire. Per data from ITBIn the past 6 hours alone, the sell-side tokens have crossed the buy-side by 20.84k ETH.

The price responds to the same. Ethereum has lost most of its value against its top 10 peers in the past 24 hours. After falling nearly 7% on the daily window, ETH was trading at $1575 at the time of writing. And if network activity doesn’t improve, burn rates stagnate and selling pressures build, the price dip is likely to continue.

Read more: Ethereum: How supply and demand will change the value of ETH after the merger