Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

RIYADH, Saudi Arabia – Targets for 100 percent electric vehicle adoption by 2035 cannot be achieved without an unprecedented acceleration in copper mining, International Energy Forum Secretary General Joseph McMonigle said.

Copper is the most essential mineral for societal development, but the growing need for electrification worldwide cannot be met if limited supplies of copper are occupied by the huge demand for batteries for electric vehicles. This is evident from a new report published today by the IEF.

“Under current copper mining policies, it is highly unlikely that there will be enough additional new mines to achieve 100 percent electric vehicles by 2035, which is only the first small step toward decarbonization. So we have to manage this transition,” said Mr McMonigle.

“To make the most of available copper supply, governments must prioritize electrification across the economy, which forms the basis of climate policy. In addition, governments must encourage and support new copper mining projects because without this, 100 percent EV adoption is not an achievable goal,” he added.

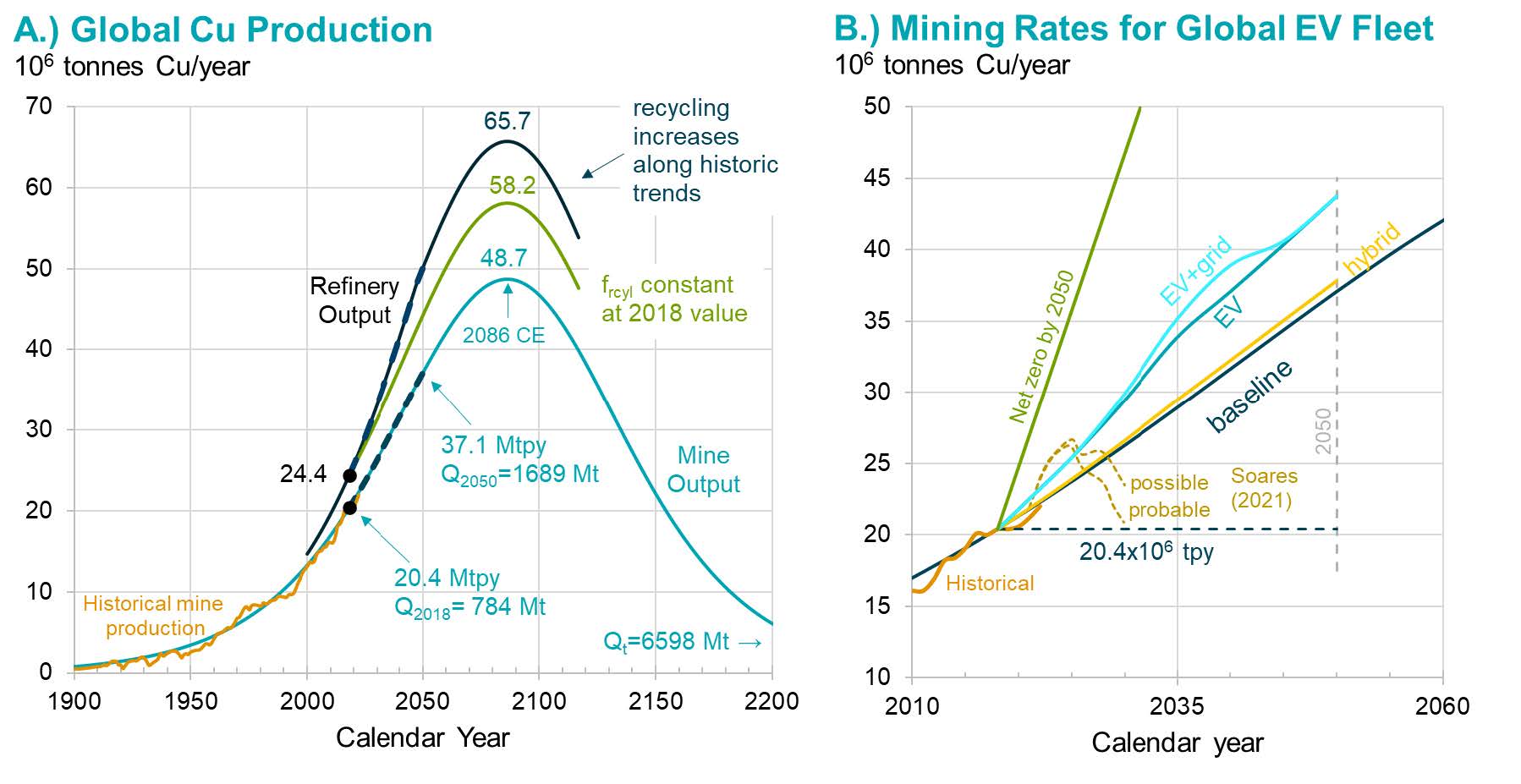

The report “Copper Mining and Vehicle Electrification,” by leading experts Lawrence M. Cathles and Adam C. Simon, analyzes historical trends in copper demand and mine production. It shows that while copper resources are available, achieving 100 percent electric vehicle production by 2035 would require unprecedented production rates in the mines.

To meet business-as-usual trends without full EV adoption, the world will need to mine more copper in the next 30 years than in all of history, the report said. Electrifying the global vehicle fleet would require the opening of an additional 55 percent more new mines than already expected.

“We believe the EV industry will remain an important segment of the market and should continue to thrive based on consumer preference and the growing range of available vehicles, but 100 percent adoption by 2035 is unlikely,” he said. Mr. McMonigle.

Copper plays a crucial role in the generation, distribution and storage of electricity, and electrification is one of the most effective ways to reduce dependence on fossil fuels. But the huge copper demand for electric car batteries will compete with the electricity needs of countries in the early stages of development.

“Demand for copper for electric car production could very substantially increase copper prices and significantly hinder the advance of less developed areas,” the report said.

EVs require 60 kg of copper, compared to 29 kg for a hybrid electric vehicle and 24 kg for a combustion engine vehicle. Switching the global fleet to hybrid would therefore have a negligible impact on copper demand.

The report cites a February 2024 report from the American Council for an Energy-Efficient Economy, which found that electric cars and hybrids scored similarly on their human health costs from air pollution associated with the production and disposal of vehicles, the production and distribution of fuel or electricity. and vehicle exhaust emissions.

The IEF report provides a detailed outlook for copper supply and demand, showing that copper mining requirements will increase significantly between 2018 and 2050.

“During this 32-year period, the world will need to extract 115% more copper than has been mined in all of human history up to 2018,” the report said. “Future production from existing and new copper mines is especially needed for developing countries to catch up with the developed world.”

According to the report's basic copper supply outlook, based on historical trends, supply will rise 82 percent by 2050, peak in 2086 and then decline sharply. However, the report also cites projections based on the pipeline of copper projects, which show a decline in supply as early as 2026.

The report argues that mining should be recognized as essential and that exploration and responsible development of copper mines should be strongly encouraged.

It highlights several constraints on increasing copper supplies, including limited access to land for mining, low discovery rates and a 23-year lead time before mines come into production. Even where significant copper deposits have been discovered, many governments have proven reluctant to approve mining permits.

In North America, mining permit applications have been canceled in Alaska, Minnesota and Panama, postponed in Arizona, and significant acreage has been withdrawn from exploration in Minnesota. The report highlights the case of the underground Resolution copper project in Arizona, which would be the largest in North America, producing 500,000 tons per year.

“Despite approval in 2014 by the US Congress, it has still not received approval to produce copper,” the report said.

Mining will need to explore and mine deeper to get the copper the world needs, the report said. Deeper underground mines such as Resolution can be mined remotely, which is safer and has a smaller carbon footprint.

Article by International Energy Forum.

Do you have a tip for CleanTechnica? Do you want to advertise? Would you like to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policies here.