According to Counterpoint Research, which tracks monthly shipments of smartphones by brand to various channels, smartphone shipments decreased by 9.2% month-on-month in May, and inventory uptake in online channels also decreased, so brands are in the warehouse. I had a few weeks in stock.

“Inflationary pressures and low disposable income are declining for all brands, but some brands have a large inventory by the end of the second quarter,” said a senior analyst at Counterpoint Research. One Prachir Singh says.

Market analysts who don’t want to be nominated said inventories of models of fast-growing Chinese brands have been stagnant for more than 12 weeks.

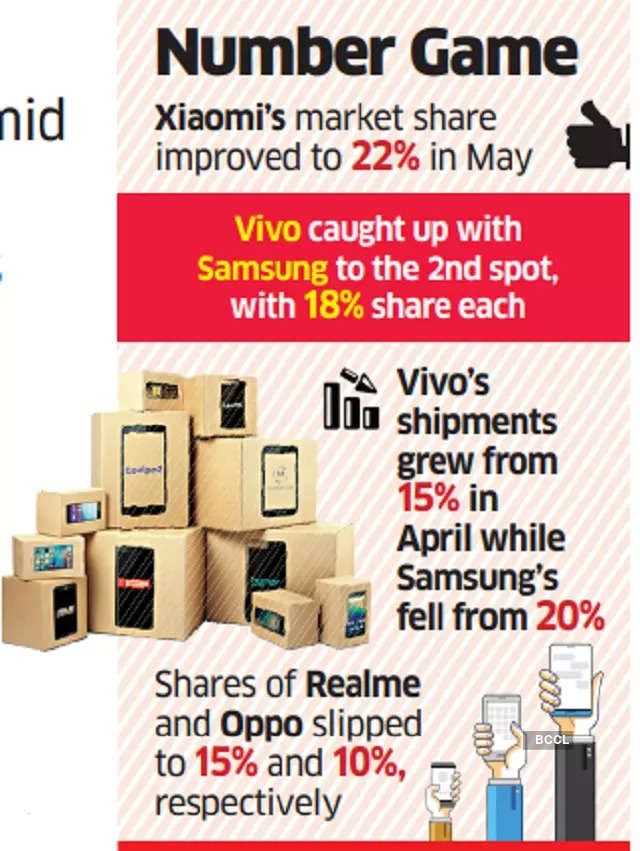

The top five saw changes while Xiaomi was still leading the market in May. According to Counterpoint Research data, Vivo has caught up with Samsung, each with an 18% share. Vivo shipments increased from 15% in April, while Samsung shipments decreased from 20%.

Xiaomi’s market share increased from 21% in April to 22% in May. The Chinese company is being investigated by the enforcement agency on suspicion of violating the Federal Emergency Management Agency (FEMA).

Shares of Realme and Oppo in April 4 and 5 fell from 17% and 11% in April to 15% and 10%, respectively.

Navkendar Singh, research director at market research firm IDC, said the company does not expect a surge in sales this year. “Although supply is improving, supply of 4G chipsets is still a problem, which is why demand is a problem, and we expect mid-single digit growth. We expect IDC Frankly, it’s not that bullish for India. “

“When we talk to brands and ecosystem players, they agree more or less with us, but some are still optimistic and certainly disagree with some of the numbers out there,” Shin said. Added.

The brand hopes that sales during the festive season starting in August will regain momentum in the market. “This year isn’t that good, and demand isn’t recovering naturally after many launches, so brands are expected to start early with pre-festival sales,” says Shin.

TechArc co-founder and chief analyst Faisal Kawoosa also hopes the brand will launch discounts and offers earlier this year. “We expect the brand to roll out monsoon offers, which could boost sales a bit in the third quarter,” he said. “This is the first time many players have tried the monsoon offer to clear inventory.”

A Xiaomi spokesman told ET that the company will participate in sales events across the channel.

However, IDC’s Singh is skeptical of the impact of this year’s festival sales. “I have doubts about how much they affect, because I think it’s a structural issue,” he said. “There may be discounts on expensive iPhones, but if there is a real market, how much can brands lower the price of budget smartphones? I’m wondering.”