The crypto market has been trading in the green for the past day. The collective rally recorded by most of the top coins helped drag the total market cap above $1 trillion. While Bitcoin registered a daily gain of one digit, altcoins led by Ethereum recorded double digit gains. Shiba Inu nevertheless chose to take the first path and recorded a 5.5% increase in the said period.

Do Shiba Inu Large HODLers’ Currents Fluctuate?

SHIB’s price has clearly been bidirectional in recent weeks. Despite the daily increase noted, a small pull pack of 0.54% was noted on the hour. There were similar green-red combinations on the weekly and monthly as well.

Price swings like this usually tend to attract a lot of whales. Such participants usually buy SHIB tokens in large quantities when prices fall, and when green numbers start flashing, they gradually begin to sell and enjoy the profits.

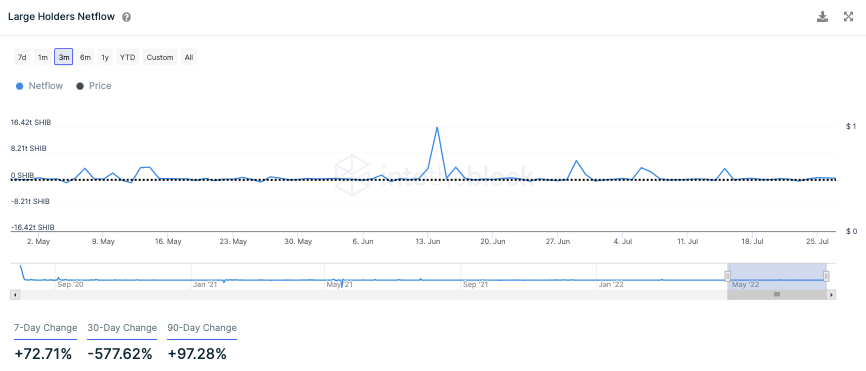

The price of SHIB has notably increased by 13% in the past month. In the same period, the net flow of large HODLers nevertheless decreased by 578%. Conversely, on the weekly window, with the price dip of 6%, net flows were up 73%.

However, when looking closely at the chart below, it can be noted that a huge drop, such as that of the 578%, has not necessarily led to a drop in flows in the negative region. They usually enter the border, which indicates that there has been no collective dumping in recent days.

At the time of going to press, the net flow of the major HODLers showed a positive value of 272.86 billion SHIB tokens, implying that the whale purchase is still in progress. In fact, as reported yesterday, quite recently, ETH whales had bought a whooping half a trillion SHIB tokens in the span of just a day, justifying the said story.

Read more: ETH Whales Buy ‘Half Trillion’ Shiba Inu Tokens in 24 Hours

So, with big HODLers/whales seemingly not in the mood to empty their bags, SHIB would probably be able to hold its current price for a while. However, the direction preference will remain closely tied to that of Bitcoin as the two cryptos share a 30-day high correlation of 93%. So a trend change in the broader market would invalidate the previously discussed statement.