New Delhi: Demand for boarding passes smartphone (priced below $100 or around Rs 8,300) continued to decline in the quarter to June, a trend likely to keep the overall sector growth subdued in the medium term, executives and market research firms said.

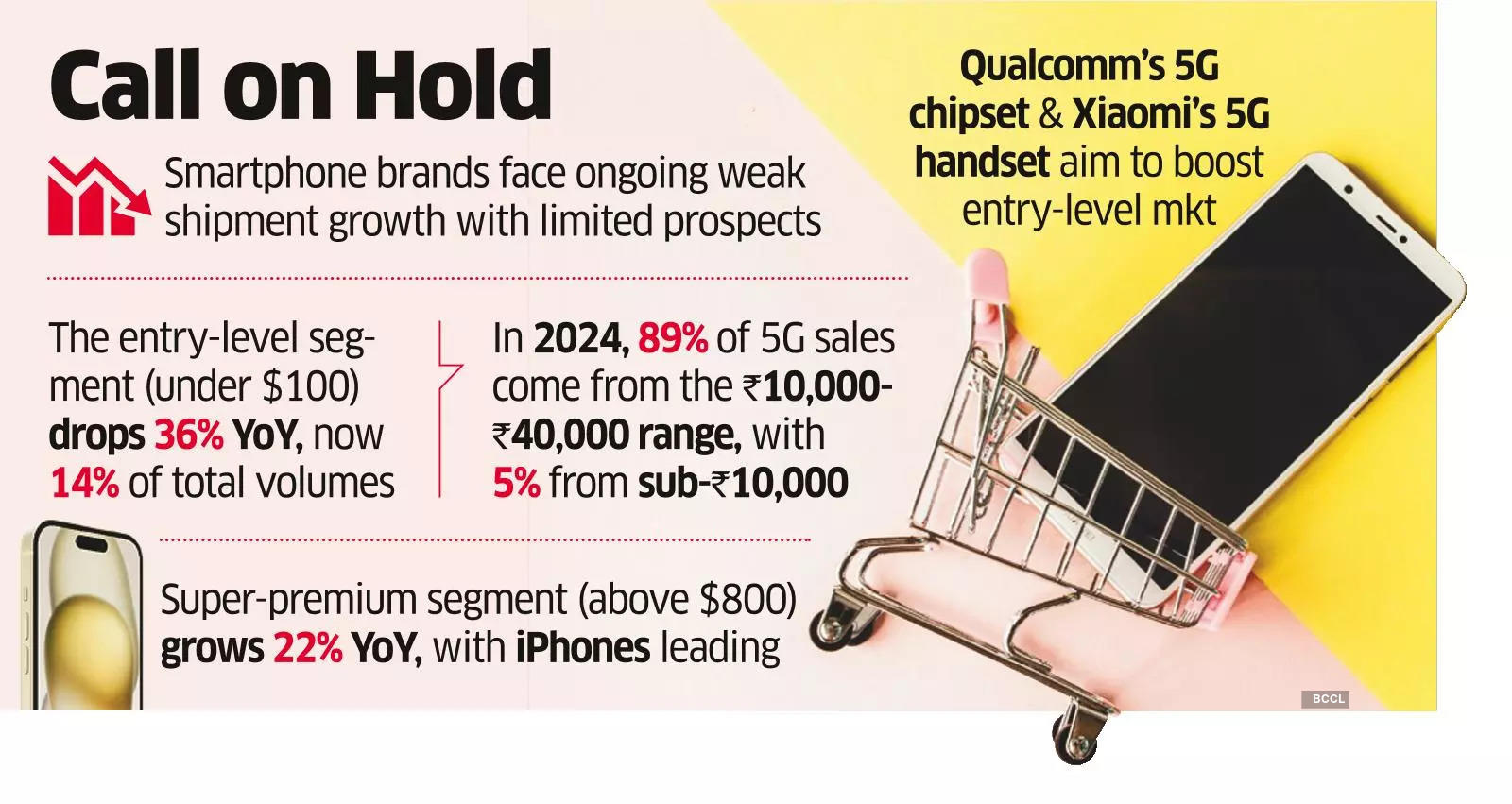

According to IDC, the entry-level segment saw a 36% decline in shipments in the April-June period. The segment accounted for 14% of total sales, down from 22% a year ago and about 40% in pre-COVID-19 years prior to 2020.

Market research firm TechArc said that only 5% of 5G handset sales in 2024 will come from the sub-Rs 10,000 segment, while 89% of sales will come from the Rs 10,000-40,000 price segment. Overall, 5G handsets are expected to account for 123 million or 77% of the total smartphone shipments this year, it said.

The sub-Rs 10,000 segment has recently been in the spotlight with the launch of an affordable 5G chipset by Qualcomm, with market leader Xiaomi announcing that it plans to introduce a budget 5G device by the end of the year.

However, not all smartphone makers are convinced. “We are still evaluating whether we should re-enter this segment with the 5G chip as there are few buyers for these devices now,” said an executive who attended the Qualcomm event on condition of anonymity. “Brands have all moved to higher price points and it will be counterproductive to go back to the entry-level segment in a significant way.” The continued decline in volumes in this segment is a result of consumers moving up the price ladder and opting for high-end premium smartphones, backed by a slew of offers such as financing options and cashbacks, resulting in faster growth of higher price points over the years.

A Canalys study found that about half of consumers switching from feature phones to smartphones opt for a much more premium pre-owned phone from the unorganised market. A smaller proportion opt for a Rs 15,000-20,000 device using financing options, while only about 25% of users opt for an entry-level model, the findings show.

In contrast to the declining entry-level segment, the super-premium segment (above $800) saw a 22% increase in sales in the April-June quarter, led by the iPhone, which accounted for 83% of shipments in this segment, followed by Samsung with an 11% share, according to IDC.

“Entry-level devices will continue to be a challenge this year despite efforts to bring affordable 5G smartphones to the market,” said Navkendar Singh, deputy vice president, IDC India.

Canalys said the market is struggling with fluctuating demand in the mass market segment, a slow transition from feature phones to smartphones and increasing adoption of second-hand smartphones.

“Even if you manage to launch a 5G device in the entry-level segment, you have to compromise on some aspects of the experience that consumers want. The hardware gets a lot better when consumers can spend Rs 2,000 more, making the entry-level segment a lot less attractive than it was before,” said Sanyam Chaurasia, Analyst at Canalys.

According to the analyst, mobile phone manufacturers are being pressured by their component suppliers and telecom operators to launch low-cost 5G phones so that they can strengthen their respective balance sheets with higher volumes.

However, retailers are more inclined to offer mid-range and higher-end smartphones because dealers can make higher margins. At the same time, consumers have also started to see smartphones as more than just a device for making calls and now want something that better suits their purpose, Chaurasia said.