The Solana-based algorithmic stablecoin, Nirvana, is said to have been attacked by a flash loan. According to the Twitter user “FA2| SolanaFM“, the exploit amounted to $3.49 million.

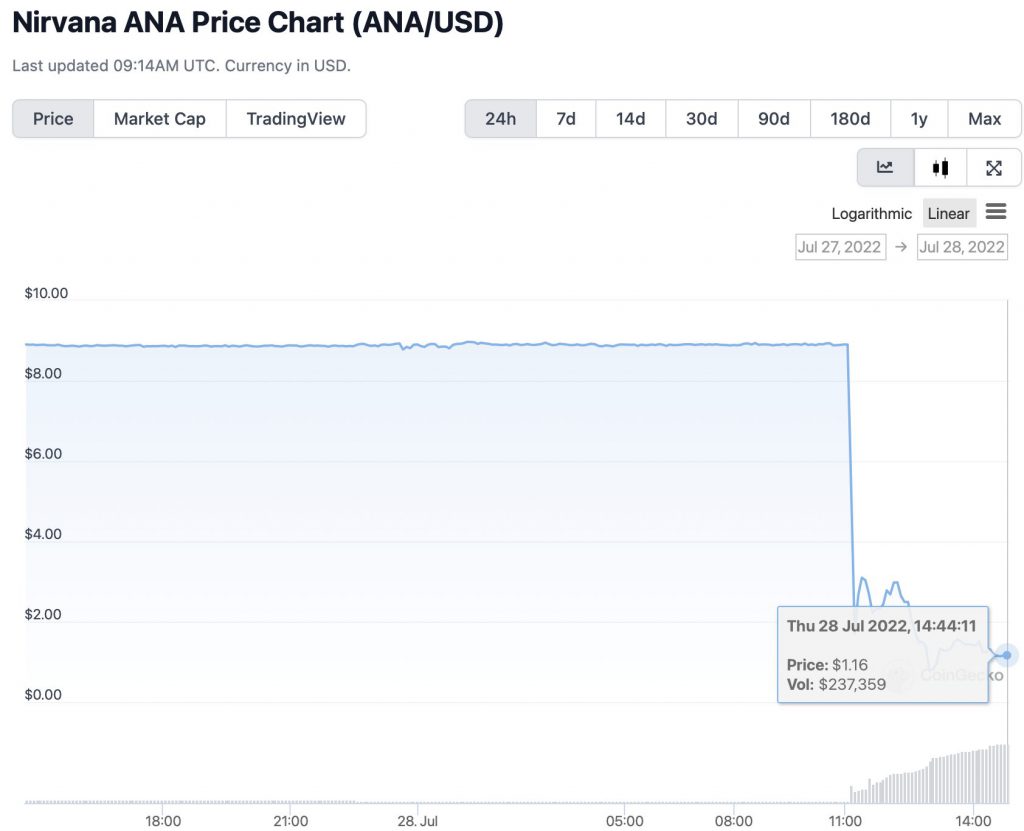

Nirvana has two tokens, a stablecoin NIRV and ANA, a volatile asset with a reserve-backed rising floor. Both tokens have witnessed a massive drop in recent hours. Their stablecoin NIRV is down nearly 90%.

On the other hand, ANA is down almost 84%.

How was the exploit performed? Solana FM explains

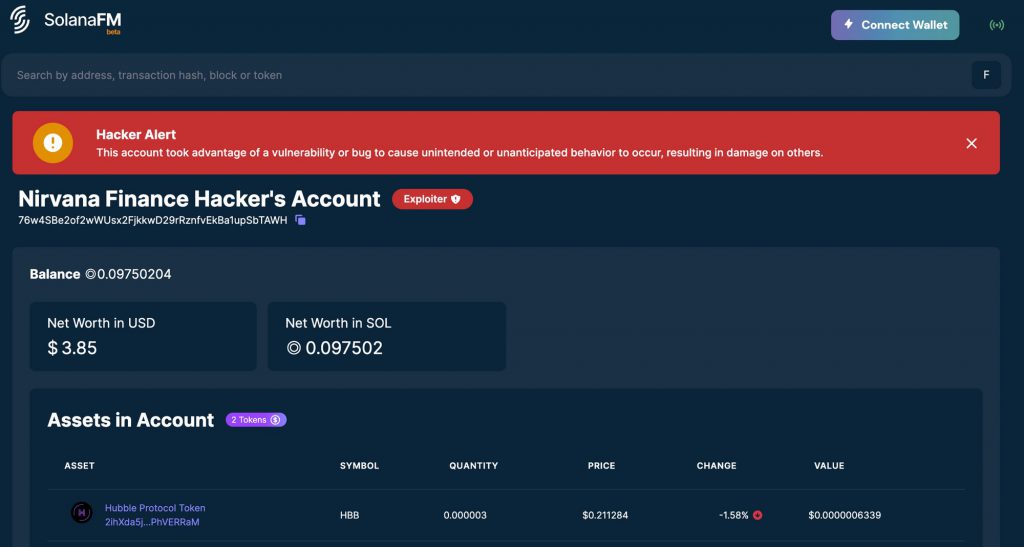

Solana FM has explained the key moves during the exploit. Two key accounts were involved – the Nirvana Treasury Account and the Nirvana hacker account. Both accounts are tagged on the Solana FM explorer.

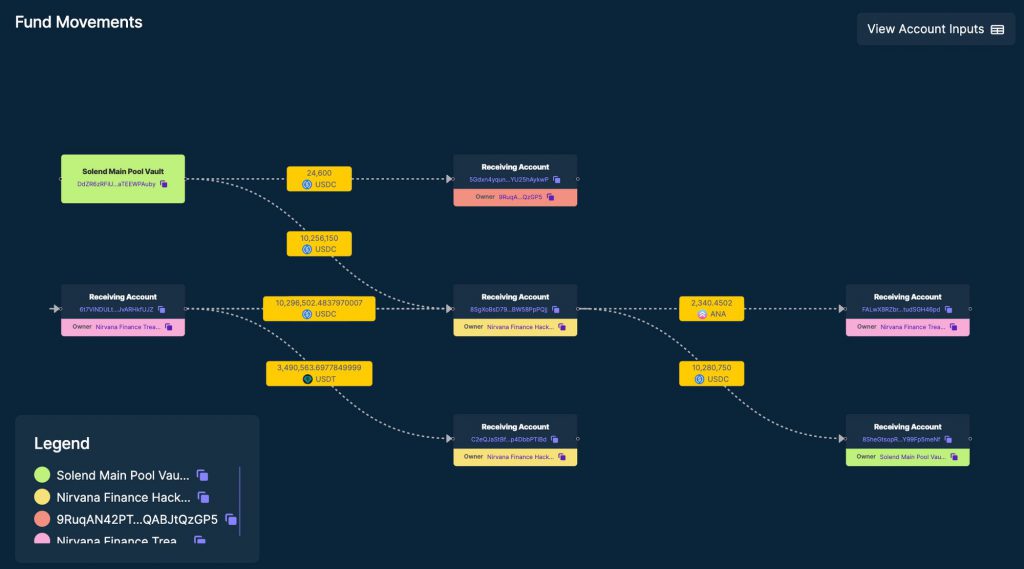

The hacker uses Solend Protocol Flash Loans to Borrow $10 Million USDC from the Big Pool Vault. This amount was then used to exploit $3.49 million from the treasury of Nirvana Finance.

Using the borrowed money, the hacker struck $10M+ worth $ANA. After that, the hacker exchanged the $ANA for USDT and received $3.5 million from the Nirvana treasury. In addition, the $10 million USDC was subsequently returned to the Solend pool.

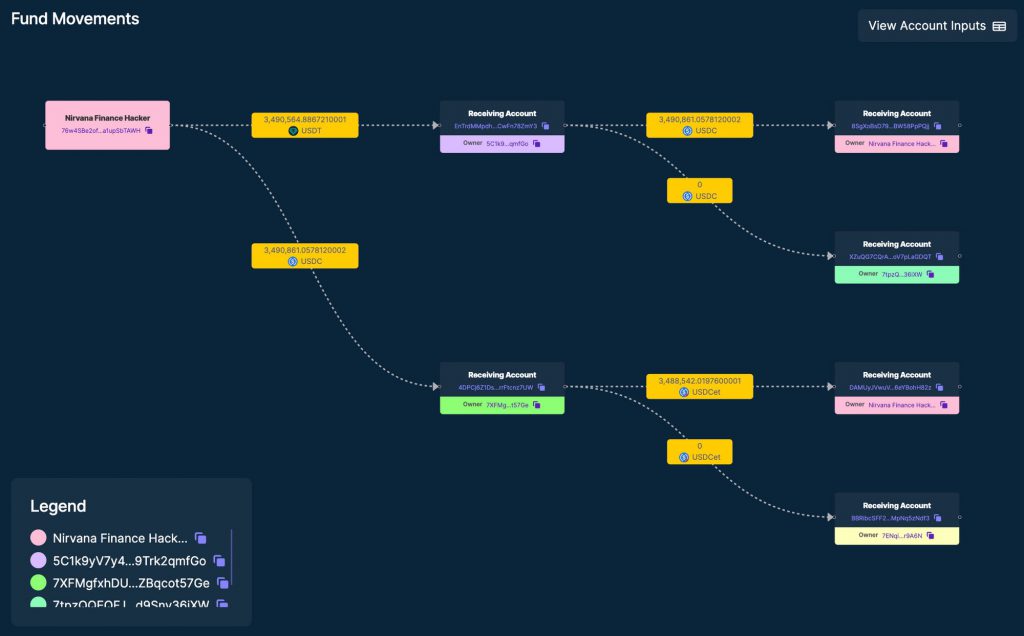

In addition, the team even explained the hackers’ exit strategy. The hacker converted the USDT into USDCet and transferred the money to an ETH account through Wormhole.

Flash loans have been a scourge in the crypto industry lately. Moreover, it is not the first time that a Solanabased project has been hit. At the beginning of July, the CremaFinance Defi Protocol Was Abused For $8.7 Million.

At press time, ANA was: trade at $1.14, down 19% in the past hour. Meanwhile, the stablecoin NIRV trade at $0.099004, down 38.8% in the past hour.