Consumers still hold their code, according to a new report by Morning Consult. This happens with Bitcoin (BTC) plunging 70% since November 2021.

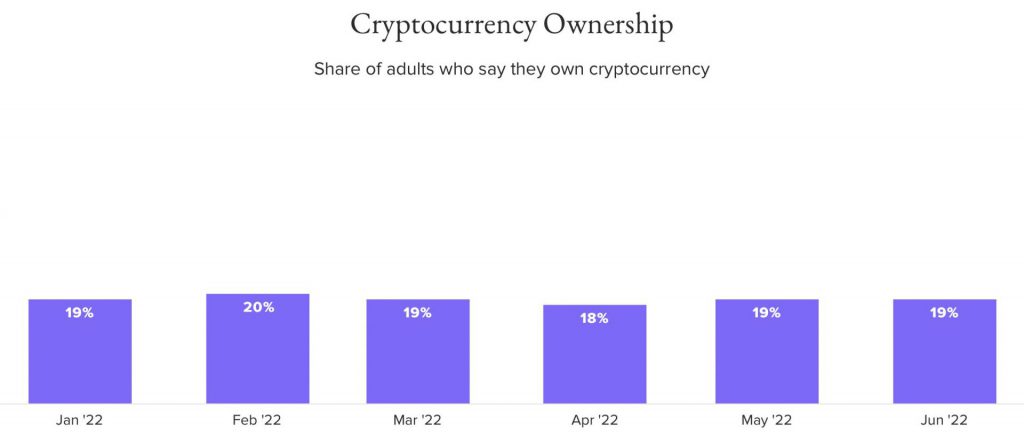

According to Morning Consult’s findings, 19% of American adults still have some form of cryptography, even if Bitcoin (BTC) falls below $ 20,000. According to the report, the number of holders in January 2022 was the same. This leads to the fact that consumers are still bullish on the industry and prefer to hold up rather than sell.

Compared to May, reported Bitcoin sales are down 4 percentage points and projected purchases are down 3 percentage points. According to the report, cryptocurrency owners seem to be preparing for the crypto winter. They want to reduce transactions as they limit the purchase of risky assets due to the outlook for inflation and recession.

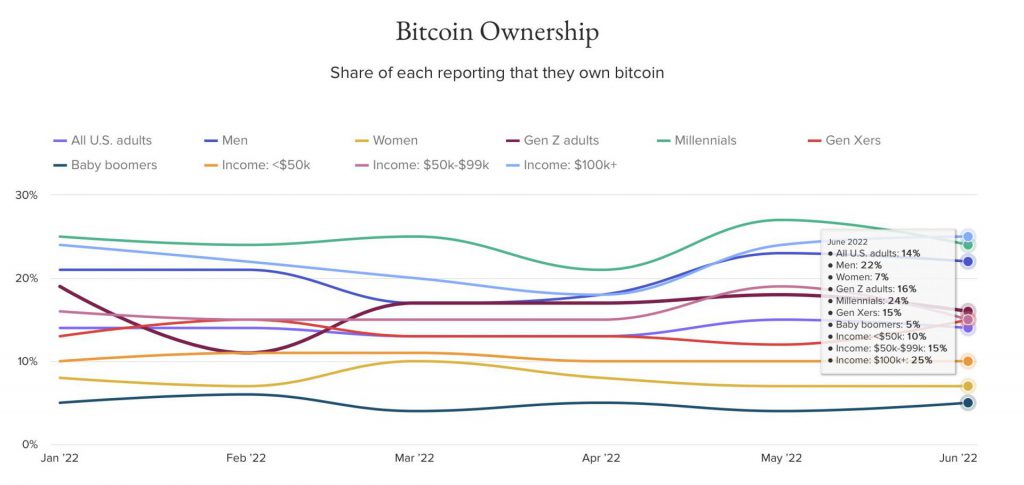

The Morning Consult report also states that millennials hold the largest share of BTC holders among those surveyed.

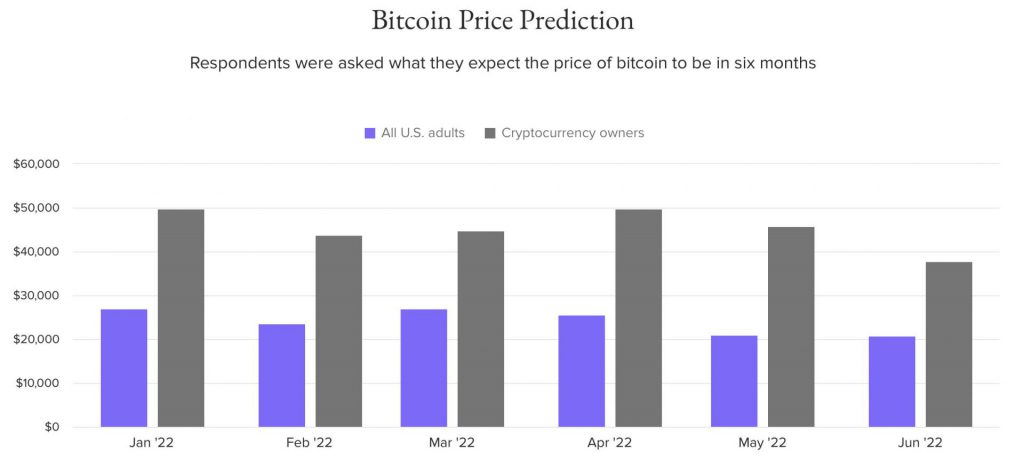

Expectations for BTC prices from cryptocurrency owners are still bright but cautious. Typical adult cryptocurrency owners expect Bitcoin to cost less than $ 38,000 in six months. This is the lowest prediction since Morning Consult started tracking. However, it still exceeds the expectations of the general public.

Bitcoin at the bottom?

BTC has been hit hard by the recent cryptocurrency crash. The widespread decline in cryptocurrencies in 2022 was caused by tightening monetary policy, the decline of speculative enthusiasm, and the collapse of digital asset ventures. However, there are faint signs that price pressures that drive rising interest rates may have peaked, and the global market is not bleak.

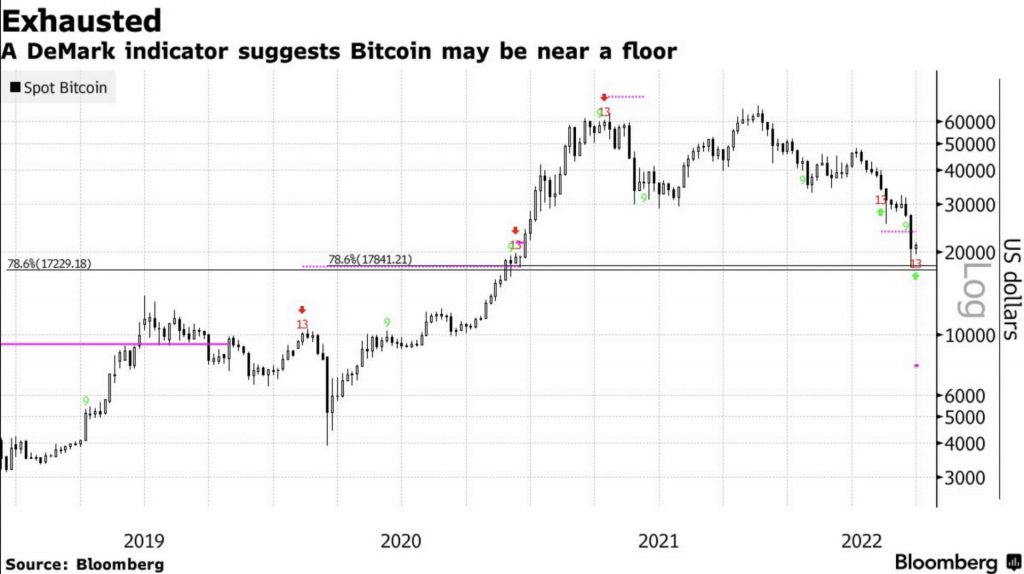

According to Glassnode, Bitcoin’s historic downturn has taught us that it may be near the bottom of the bear market.

The popular DeMark technical indicator, called TD Sequential, means that most of Bitcoin’s sales have already passed. This study uses a counting technique to graph patterns to determine when market trends peak. According to supporters of the survey, Bitcoin has printed up to 13 downward counts, indicating that a reversal is imminent. Earlier DeMark analysis showed changes in the general trend of Bitcoin.

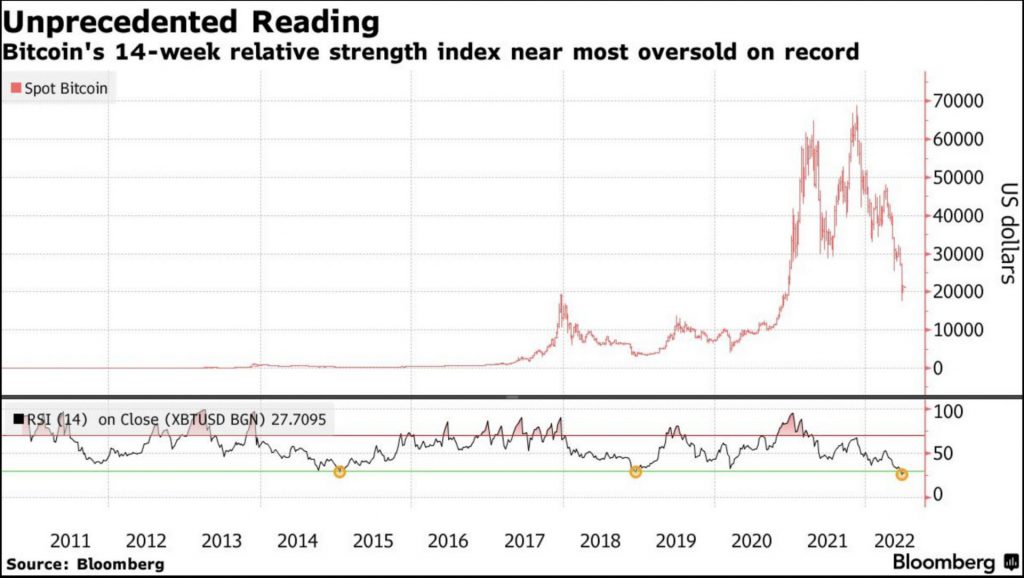

In addition, the Relative Strength Index indicates that Bitcoin’s current selling should stop. This indicator is currently approaching the lowest point in Bloomberg’s record since 2010. Every week we are in the “oversold” territory of less than 30. Tokens rose significantly when the indicator last flashed “oversold” in 2018.

At the time of the press, BTC was trading at $ 20,872.81 which was down 2.3% in the last 24 hours.