Even though Bitcoin’s macro-accumulation trend is on, institutions have simply revolved around BTC. Most of their recent purchases were not significant. As a result, Bitcoin consolidated in the $ 20k- $ 22k price range.

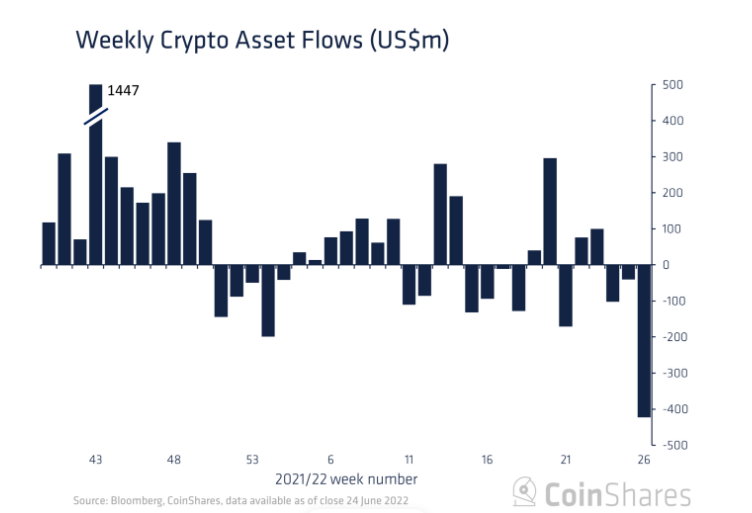

In fact, CoinShares’ latest weekly report revealed that crypto-digital investment products noticed one of their most important outflows last week.

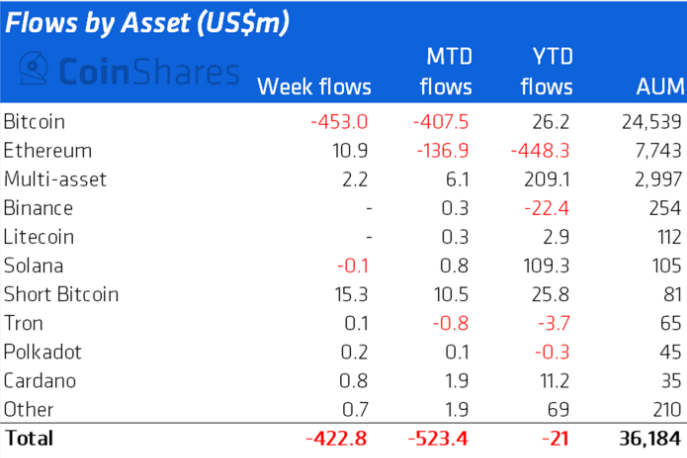

Most altos, including Ethereum, have seen influx. Bitcoin was the only major currency to register a significant amount of outflows. By CoinShares,

“The outflows were exclusively focused on Bitcoin, which totaled net outflows for the week totaling US $ 453m.“

Who left out their Bitcoins?

When geographically broken down, the outflows were almost exclusively from Canadian exchanges, and “one specific” provider.

Canada’s Purpose Bitcoin ETF recently spotted massive outflows, summing up to 24,510 BTC on Friday. In particular, the fund’s Bitcoin under management has since failed by 24,545 BTC, compared to the day before the crash, making it a 51% drop.

These were also the most serious redemptions recorded in the short-lived BTC ETF history. The fund’s current Bitcoin under management is now at lows not seen since last October.

One of Arcane Research’s reports expressed the plausible reason.

“The huge outflow is probably caused by a forced seller in a large liquidation. ”

However, if ProShares’ outflow is stripped, CoinShares has revealed that Bitcoin would add up to $ 70 million in total inflows last week. The same, according to the data aggregator, clearly highlights the “highly polarized” sentiment among digital asset investors.

Are whales on another page?

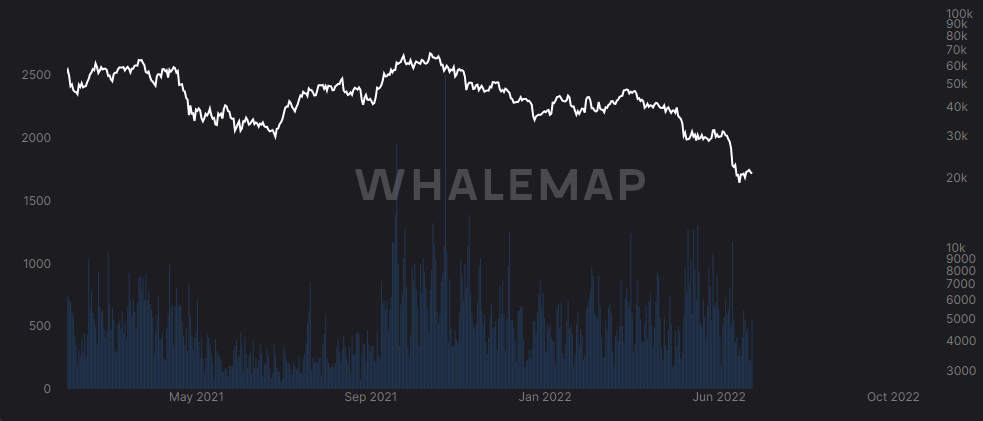

In addition to Purpose’s dump, it’s interesting to note that major players have reduced their cumulative number of Bitcoin transactions overall.

Even though the transaction score metric is a double-edged sword, it can be noted from below that during most downward trend phases in the recent past, the score has declined and vice versa. Thus, the current trend reveals whales’ declining appetite and dwindling interest with Bitcoin.

The forced sale of Purpose’s Bitcoin pushed the asset’s price down to $ 17,600 over the weekend, but the market was quick to absorb the selling pressure and return to above $ 20k. The same suggests that the continued macro-accumulation trend has more weight compared to the recent institutional dumping and whale activity.