NEW DELHI: The Indian smartphone market will be stable in 2023, with 5G handsets representing a 50% share of the total market by volume, said a top executive of Nokia phones maker, HMD worldwide.

“I think the smartphone market in the Indian market is evolving. There are still more than 300 million 2G users in the Indian market. And we believe they will move to smartphones,” Sanmeet Singh Kochhar, Vice President, HMD Global, told ETTelecom in an interview.

Kochhar said the price of less than Rs 10,000 will be important while the Rs 10,000 to Rs 15,000 will coexist with 4G and 5G devices. “We will see both segments coexisting and for around Rs 15,000 there will be a plethora of 5G devices.”

According to him, the smartphone market has largely moved to 5G.

The director said that the Indian smartphone market had shown good growth in 2020 and 2021 due to the lockdowns pushing people to stay connected while working from home, consuming online content and studying online. “The smartphone market has been resilient,” Kochhar claimed.

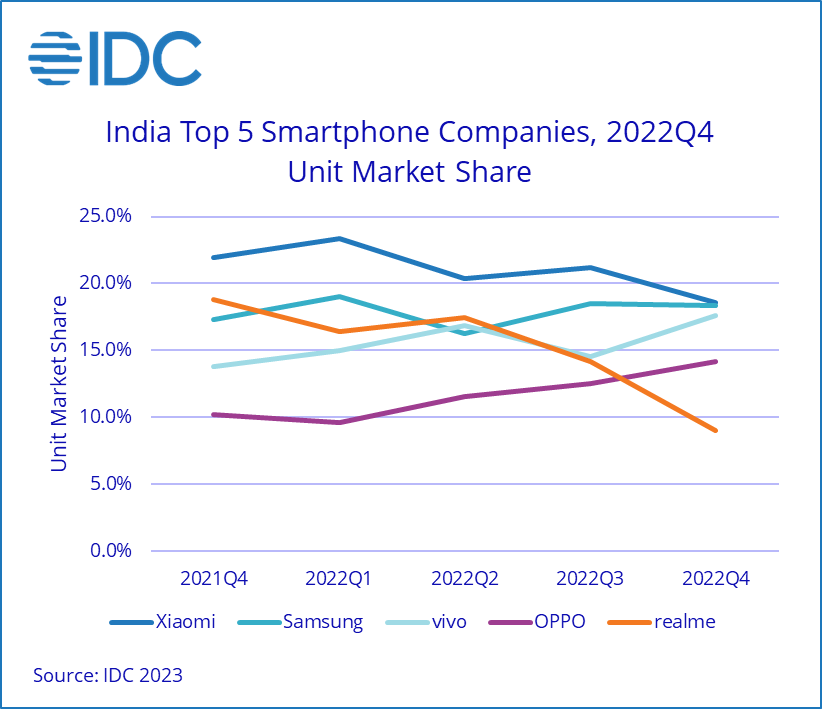

However, by 2022, the Indian smartphone market is down 9-10% year-on-year to between 144 and 152 million units, according to research firms IDC and Counterpoint.

The research firms attributed the decline in shipments to several factors, including declining consumer demand due to high inflation, and a decline in new launches in the entry-level and budget segments, which faced supply constraints at the start of the year and then low sales. demand throughout the year. the rest of 2022.

On the other hand, 50 million 5G smartphones were shipping in 2022 with an average selling price (ASP) of $395 in 2022, down from $431 in 2021, data from IDC shows. The company expects more affordable 5G launches in 2023, with 5G devices accounting for about 60% of shipments in 2023.

IDC had said in a report that the smartphone market in the first half of 2023 (H1 2023) may suffer from rising prices and excessive inventories.

Kochhar said the affordability of 5G handsets should be looked at from different perspectives beyond just the upfront cost, as a 5G chipset requires more components, driving up the price of the handset.

“We have to look at the ecosystem game. Today, more than 50%-60% of handsets are sold on finance. Let’s say you buy a Rs 20,000 handset, and you might pay only Rs 5,000 upfront, and the balance paid through EMI. So it’s about having 5G handsets and connecting with the different funding partners and making it more affordable for the consumer,” he said.

Affordability, according to the HMD Global manager, can also be supported with telco partnerships, bundling pre-installed applications and adding value-added services (VAS).

Kochhar said that features like better and longer battery life, smooth Android OS experience, good camera and imaging capabilities, along with artificial intelligence (AI) enhancements will encourage users to upgrade their existing handsets in addition to 5G support .

“I think those are some of the important factors that people will be looking for, both in terms of software and hardware. We are working closely with our R&D team and partners to see how we can improve that overall device experience for our customers,” said Kochhar.