Gold prices hit new highs in 2024 as central banks of developing countries accumulated tons of the precious metal. The accumulation wave was stimulated by China, Russia, India, Brazil and South Africa adding billions to their central banks.

The central bank-induced spike in gold prices spurred investment from private investors and institutional funds. All three forms of investors made profits as the precious metal soared between January and April of this year.

Also read: BRICS: India and Nigeria complete major partnership, ditching US dollar

This is when the gold price can reach $3,000 per ounce

The next target for gold remains at $2,500 and bulls are aiming for the $3,000 per ounce mark. The XAU/USD chart, which tracks its performance, shows prices hovering around $2,314 on Wednesday. It rose almost 0.30 points in day trading, rising 0.01%.

Also read: BRICS: Economist predicts one last rally before markets crash 50%

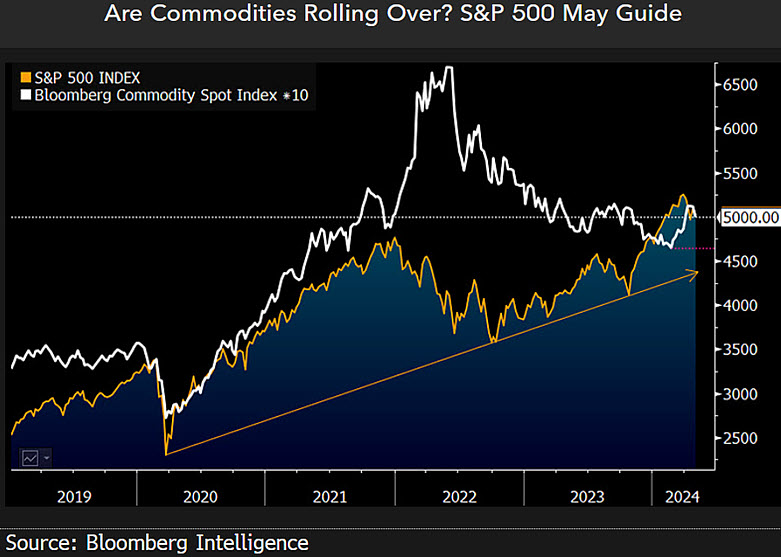

So when will the gold price reach the $3,000 mark? Senior commodity strategist at Bloomberg Mike McGlone predicts in the latest update that the next increase in the gold price will be $3,000 per ounce. He also warned that crude oil prices could fall dramatically to $50 a barrel due to tensions in the Middle East.

Also read: Commodity Market: Copper Price Rises 50% to Reach $15,000?

According to McGlone's forecast, gold has a better chance of reaching the $3,000 mark in the next six to 18 months. Therefore, the precious metal could reach the target by the end of 2025, he predicted.

“Gold $3,000, crude oil $50, copper and corn $4 versus S&P 500 at 5,000. The buoyancy of commodities may depend on the S&P 500 staying above 5,000. The fact that beta could fall 10% below that and still be in an uptrend from the 2020 low could pose risks of commodity deflation. Paths for gold to $3,000 per ounce, WTI crude to $50 per barrel, and copper and corn below $4 per pound/bushel could become easier if the index breaks through the 5,000 support.” he estimated.