Yesterday, Bitcoin broke above $20k for the first time since September 18. On a certain moment, the traded near $20.4k on Tuesday. However, it was unable to sustain its bullish rally for long. Two long red candles on the hour completely flipped the story for Bitcoin. During the early hours of Asian trading hours on Wednesday, the largest crypto made a brief visit to $18.4k.

Deciphering What Led to the Fall of Bitcoin

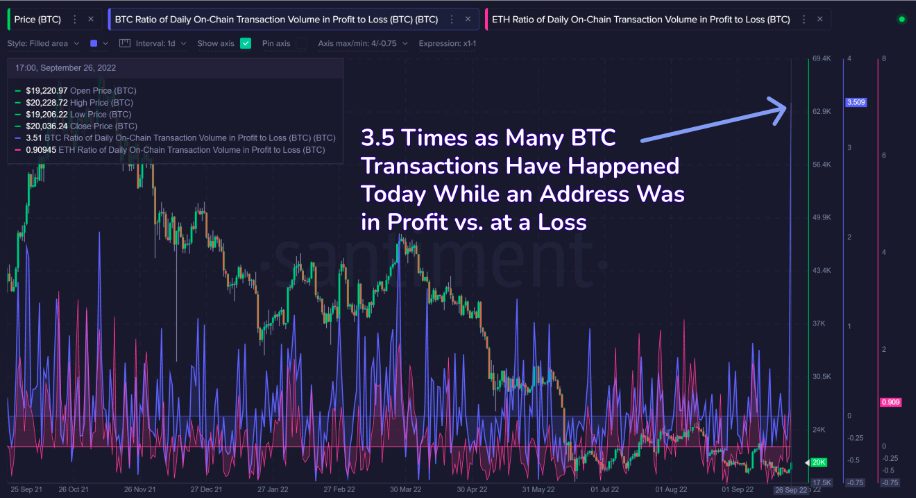

Exchanges have been filling Bitcoin profit-taking orders lately. A recent tweet from Santiment revealed that in the past day, the number of transactions executed by profitable addresses was 3.5 times more than that executed by losing addresses. In fact, the $20k psychological level was seen by investors as an attractive zone to let go of HODLings. Continuing on the same, the analytics platform’s tweet noted:

“Many traders apparently waited for the $20k threshold to start selling their bags. Once Bitcoin rose above this psychological level, massive profit-taking followed.”

The increasing pressure was further reflected by the rising volume figures. Until recently, the reading of the said metric remained undernourished. Yesterday, however, it peaked and claimed a new quarterly high. The upswing essentially came about when prices started to fall, likely indicating mass selling.

“During the big leg on Tuesday, $BTC spiked to its highest trading level since June 14.”

Furthermore, it is worth noting that in the price range between $18.91k and $20.07k, about 2.4 million addresses bought a total of 1,478 million BTC. So if all prices bounce back from current levels, Bitcoin will once again be tested by the sellers on the same slippery slope if and when they break even.

In addition, a recent analysis by CryptoQuant revealed that Bitcoin’s speed is on the decline. As such, this metric divides the total number of coins moved in a year by the total supply to measure how quickly coins are distributed in the market. Continuing the connotation of the metric’s current state, the analysis noted:

“… It seems that even a small price shock can cause dumping.”

Well, at this stage it looks like Bitcoin is stuck in a rut, and to break free, buyers will have to step in and do some of the heavy lifting.