AppleInsider may earn an affiliate commission for purchases made through links on our site.

Apple was one of the few companies to grow its wearables business in China in 2022 with the Apple Watch Ultra help create a new segment for professional smartwatches.

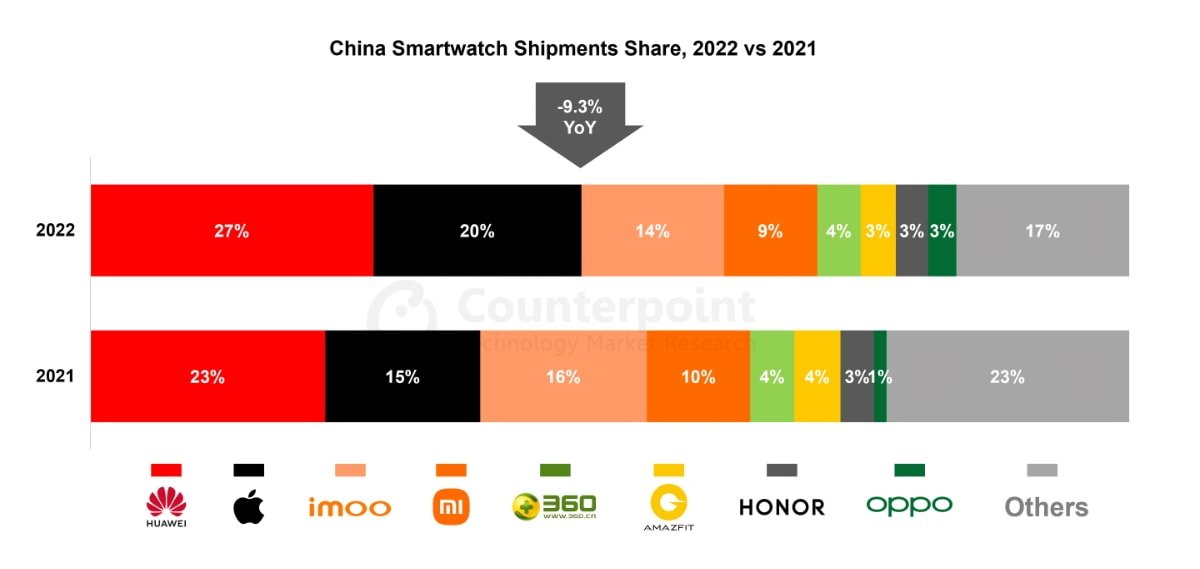

Smartwatch shipments in China fell 9.3% year-on-year in 2022, mainly due to the impact of the COVID-zero policy. As a result, the market contracted to pre-COVID levels, registering quarterly year-over-year growth only in the first quarter of 2022.

Research of Counterpoint shows that Huawei and Apple dominated China’s smartwatch industry in 2022, with a combined share reaching nearly 50%. Apple, OPPO and Huawei were the only top brands to grow year-over-year at 22%, 105% and 9% respectively.

Strong sales of Apple’s Watch Series 7 models and the recently announced Watch Series 8 and Ultra models helped Apple grow after shipping in China. Continuous innovation in health monitoring features and an ideal data and interaction experience have fueled Apple’s success.

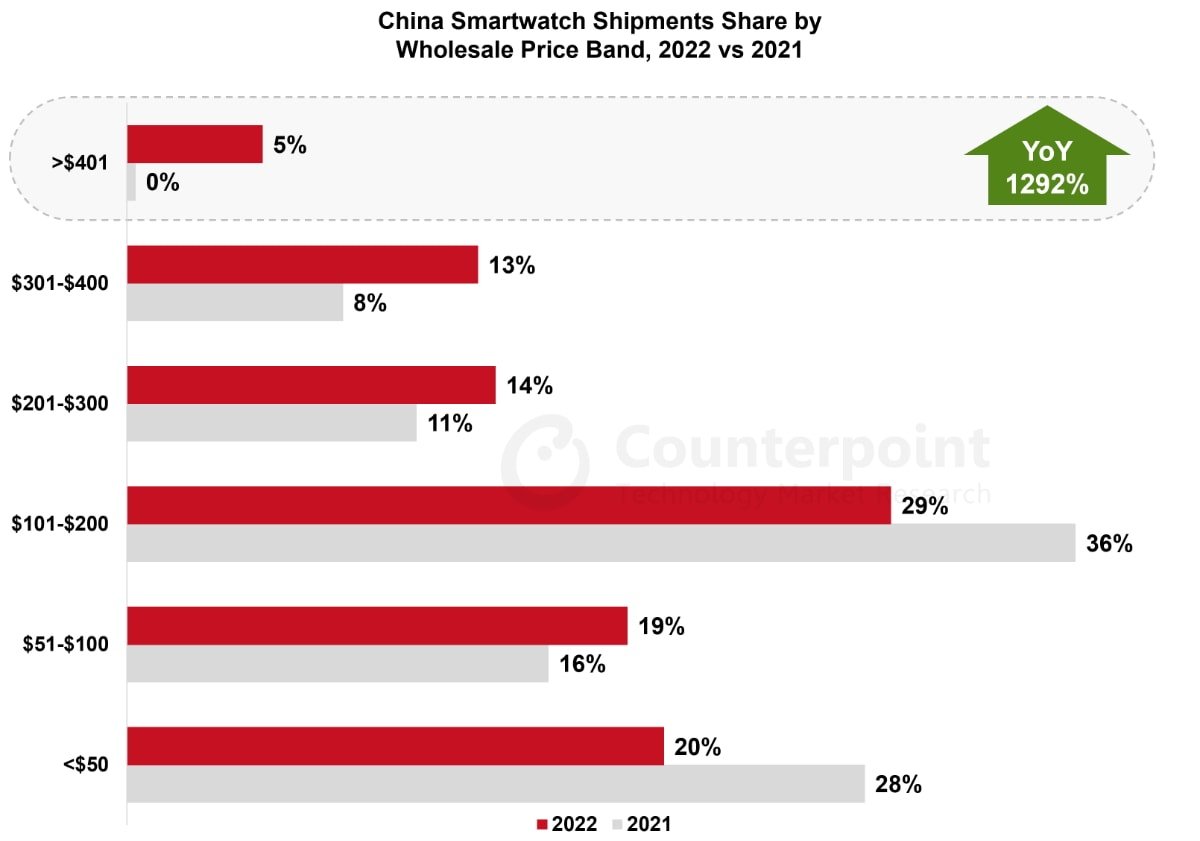

Creating a new segment for professional smartwatches, the Apple Watch Ultra helped Apple dominate the premium markets.

The most significant aspect of the year was the market share gain of the high-to-premium segment for smartwatches above $200. Shipments in the $301 to $400 segment grew 46% year over year, while shipments in the $301 to $400 market grew $401 and more grew 1,292% year over year.

“This shift to the high-end segment is similar to the shift in the smartphone market in 2022,” said senior analyst Ivan Lam. “In recent years, the marketing efforts of Apple and Huawei have led high-end consumers to view their smartwatches as professional devices with advanced sports and health monitoring capabilities.”

Counterpoint expects the Chinese smartwatch market to recover due to active volume pressure from OEMs and post-COVID reopening measures in 2023. The average selling price of the market may also increase due to continued demand for more professional smartwatches.