Crypto.com is currently the 10th largest holder of Shiba Inu’s (SHIB) descendant token Bone ShibaSwap (BONE). Since March 2, the popular exchange has purchased 2.16 million BONE tokens worth $2.33 million. BONE will be the governance token for Shiba Inu’s upcoming Layer-2 network, Shibarium. While we don’t have an exact launch date, many expect the upcoming Tier-2 to go live very soon. Crypto.com’s BONE purchase also coincides with the exchange enabling BONE deposits and withdrawals. The exchange enabled deposits and withdrawals from BONE through the Cronos app.

Crypto.com is just behind fellow Singapore-based exchange, MEXC, which ranks 9th among BONE holders. The top holder is an unidentified wallet containing over 32.8 million BONE worth $40.4 million. The MEXC Global exchange affiliated wallet “Mexc.com 3” takes second place, holding up to 18.51 million BONE tokens worth more than $22.77 million.

The purchase of the scholarship seems to have had no effect on the SHIB offspring. The token is still down 21.3% on the weekly charts and 32.5% in the last 30 days. BONE is still down 92.72% from its all-time high of $15.50, set in July 2021.

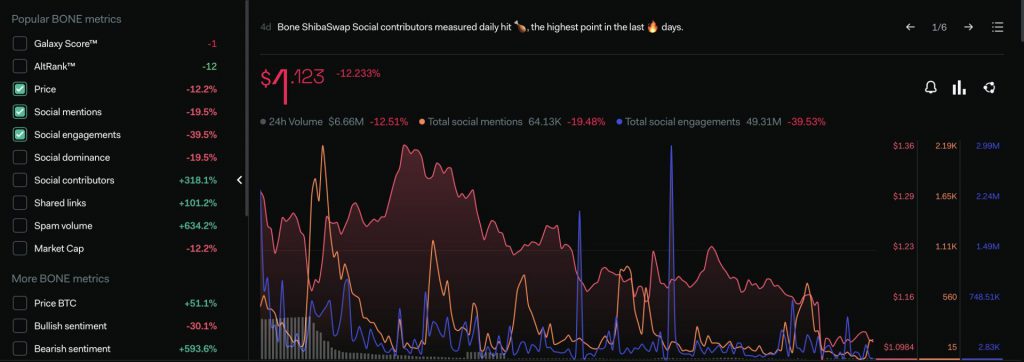

In addition, the social engagements of the token have drastically decreased. According to LunarCrush, BONE’s social mentions are down 19.5% while engagements are down 39.5%. Spam volume, on the other hand, increased by 634.2%.

Crypto.com big on Shiba Inu?

The popular exchange is also one of the largest holders of Shiba Inu (SHIB). Crypto.com’s newly created wallet has recently become the 4th most notable Shiba Inu (SHIB) holder. Last year after the collapse of FTX, exchanges began to share their reserves. It was revealed at the time Crypto.com detained 20% of its reserves in SHIB.

Recently, $276 million to SHIB tokens were moved from Crypto.com to an unknown wallet. It was later revealed that standard custody operations are conducted at the exchange. The SHIB tokens have been moved as part of the processes created to protect the funds. The CEO claims that the actions taken should have no effect on exchange users, and a report on Crypto.com’s assets is set to be made public soon.