Transactions in the crypto market have swelled in the past 24 hours. Cumulative trading volume passed $93 billion, making it the highest this week. Per data from CMCBitcoin has been one of the main contributors as it has brought in a total of $35.2 billion in volume in the past day. The rising price for its part has enabled Bitcoin to climb 9% higher on its price charts to $23k.

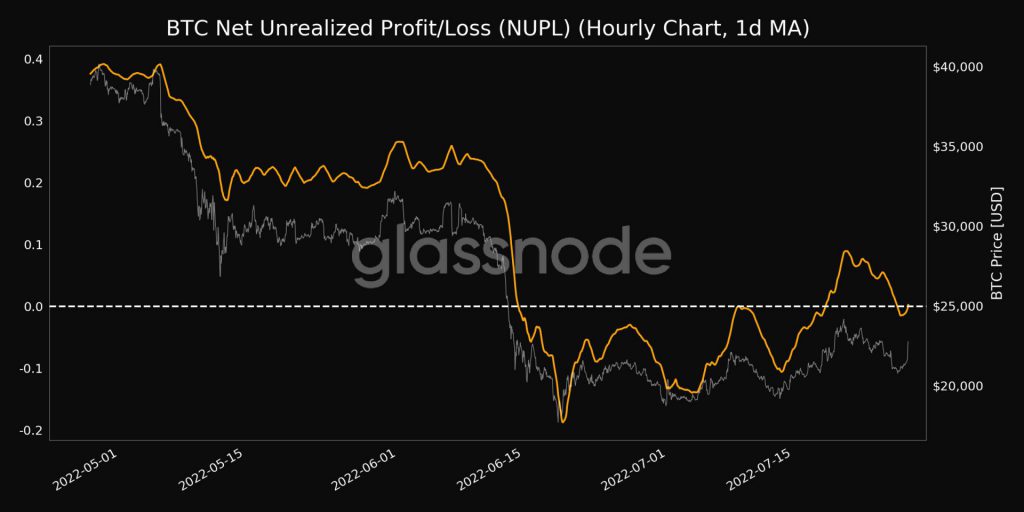

NUPL rebounds

A few hours back, the NUPL metric value crossed 0. Previously it was at -0.001, but at the time of writing it reflected a value of +0.002. This indicator basically looks at the difference between unrealized gain and unrealized loss to determine whether the network as a whole is in a state of profit or loss. Values below zero indicate that the network is in a state of net loss and vice versa. So the current uptick is essentially a good sign as it indicates that the network is in a state of net profit.

Now, even though the recently noticed trend is lean, it could help extend BTC’s short-term green wave.

Upcoming options expire

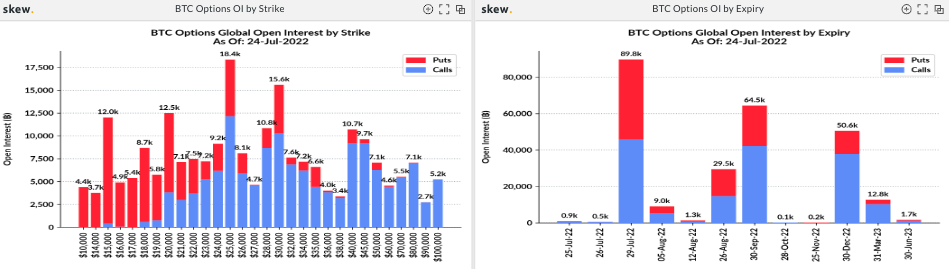

In addition to the above-mentioned fundamental positive, another important factor that could play a crucial role in dictating Bitcoin’s price is the expiration of tomorrow’s monthly options. This time the stars are a bit aligned in favor of BTC as most traders are optimistic for BTC at $22k and up.

According to Skew’s data, the July 29 expiration includes 89.8k BTC. The snapshot attached below: [right] shows that market participants are still fairly spread out about their bets. The number of calls and put contracts appears to be more or less the same.

However, when looking at the chart of the OI by strike price [left], it’s becoming pretty clear that purchase contracts dominate procedure in the price ranges stretching from $22k and beyond. However, traders are strongly bearish below $22,000.

Does Bitcoin have a ‘good’ chance of rising or falling?

So as long as the price of Bitcoin continues to swing around its current range, there is not much to worry about. More so because at the time of expiration, call traders are triggered to exercise their option to buy their respective coins. So if such a scenario occurs, Bitcoin’s rally would likely be extended.

On the other hand, if the price deflates in the next few sessions and hovers around $21k or below at the time of expiration, then the slippage could continue.

Here it is interesting to note that BTC in a band between $21.7k and $22.3k has a pretty strong support. And as highlighted by analyst Ali Martinez, Bitcoin has a “good chance” of rising to $27k as long as this demand zone holds. However, halfway through it would be tested for around $23.8k.

So if we keep the number of call bets placed in a higher range and Bitcoin hovers around one of its most vital supports, it’s likely we could notice a short breather in the coming days before the hype dies down.